US securities regulator's top cop to leave agency

By Chris Prentice

NEW YORK (Reuters) - The U.S. Securities and Exchange Commission's enforcement director is leaving the agency, the regulator said on Wednesday, marking the end of a three-year tenure during which the regulator stepped up enforcement against Wall Street and cryptocurrency firms.

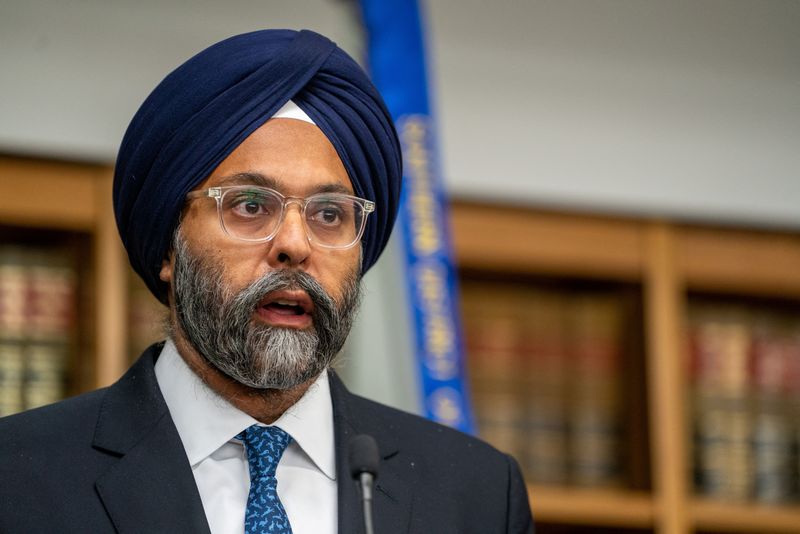

Gurbir Grewal has led the SEC's 1,500-person enforcement unit since July 2021, after serving as New Jersey attorney general as well as in other state and federal government roles. During his tenure, SEC enforcement has drawn ire from the likes of cryptocurrency and Wall Street firms for its crackdown on core business practices.

Grewal plans to leave the regulator for private practice, according to a source briefed on the matter.

His last day at the SEC will be Oct. 11, and Deputy Director Sanjay Wadhwa will take over as acting director, the SEC said.

The SEC has pursued big cases in the crypto sector during Grewal's tenure, including suing exchanges Binance and Coinbase (NASDAQ:COIN ) for facilitating illict offerings to retail investors. It also charged FTX as part of a larger government action against the exchange's multibillion-dollar fraud and sued the firm's auditor for negligence.

Under his leadership, SEC enforcement staff embarked on a sprawling, multi-year investigative initiative focused on Wall Street's use of personal devices and apps such as WhatsApp to discuss business, levying over $2 billion in civil fines against dozens of firms including JP Morgan Chase (NYSE:JPM ), Goldman Sachs and Morgan Stanley.

That "off-channel" investigative sweep, which began in 2021, is still generating enforcement actions, and has also ensnared hedge funds, private equity funds and ratings agencies.

Under Grewal, SEC enforcement has also fought Elon Musk in court over the billionaire' s failure to show up to testify for the agency's investigation into his takeover of Twitter, now known as X, and brought settled charges against billionaire investor Carl Icahn for disclosure failures.

Source: Investing.com