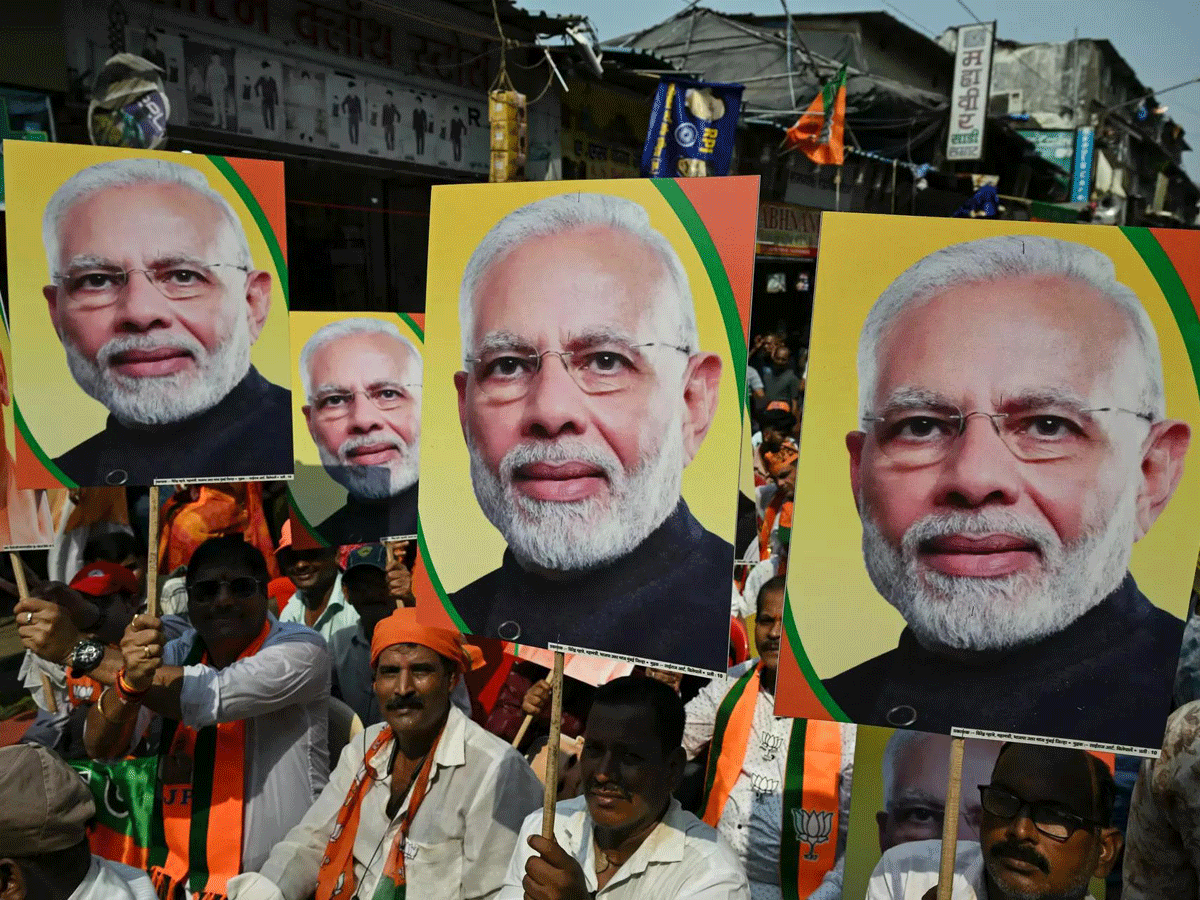

How to trade Nifty on election result day? Heads I win, tails you lose strategy

Depending on whether the Prime Minister Narendra Modi-led NDA surpasses or falls short of the expectations outlined by exit polls, the Nifty could experience significant swings in either direction once the trends of the Lok Sabha election results become apparent on Tuesday. The substantial rally of over 3% on Monday, coupled with a 15% decline in the India VIX fear gauge, indicates that market anticipation for a negative surprise has diminished.

Depending on whether Prime Minister Narendra Modi-led NDA exceeds or falls short of the expectations set by , Nifty can be hit by a wild swing on either side when the trends of Lok Sabha are clear on Tuesday.Monday's 3% plus rally, combined with a 15% drop in fear gauge India VIX, suggests the for downside surprise has eased.

"Historically VIX collapses immediately after maturity of the event, which suggests that call premia has limited room for upside, even if results best exit poll outcome in favour of the ruling party," said Anand James, Chief Market Strategist, .

The analyst's go-to strategy for such a scenario is an iron condor or iron butterfly option strategy, which bets on VIX's collapse, but also limits risk, in order to account for wild scenarios.

Apurva Sheth of has told clients to book profits in long positions after Nifty touches 23,500 and wait for dips around 23,000 to 22,800 levels to create fresh long positions. His medium-term target in Nifty is around 24,500.

for the day are seen at 23,100 levels and 23,500 for Nifty. The trading range for , which scaled past the 51,000 mark for the first time on Monday, is seen at 50,400-51,800 levels.

Strategy by Jatin Gedia of by :

There can be volatile price action. However, we see Nifty settling around 23500 on June 4. The break-even for the strategy is 22900 – 24100. Hence, if Nifty stays within this range then the strategy is likely to make a profit. Also, a cool-off in IVs is likely to benefit this strategy.

Strategy: Short Iron Fly

Expiry: 06 June, 2024

Buy 24500 CE – 91

Buy 22500 PE – 75

SELL – 23500 CE – 290

SELL – 23500 PE - 464

Max Profit – 14700, Max Loss – 10300

RISK:REWARD – 1: 1.4

Breakeven – 22900 - 24100

Margin Required – 50000

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of )

Poll Trackers

Source: Stocks-Markets-Economic Times