Harris aims at stubbornly high prices

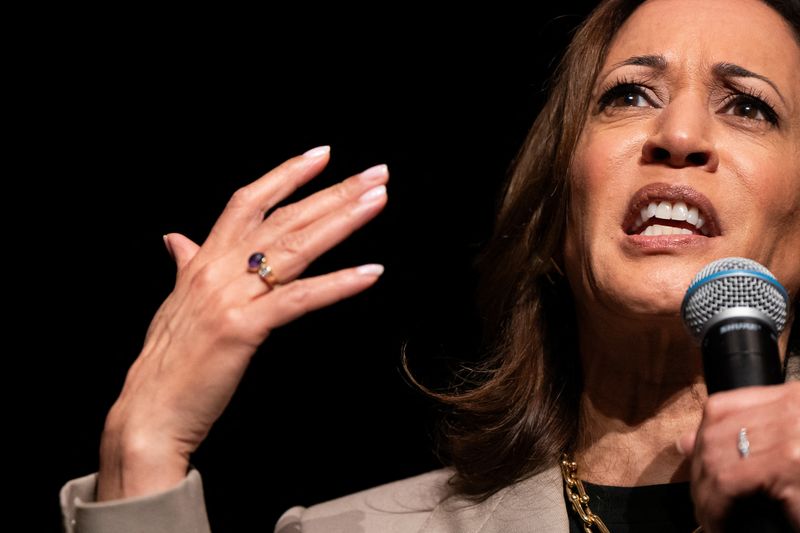

(Reuters) - Vice President Kamala Harris' speech in Raleigh, North Carolina, on Friday will focus on economics, and specifically around her plans to lower costs and target "corporate price-gouging" if she is elected president, according to her campaign.

Inflation has been a persistent sore spot for American consumers, overshadowing an otherwise healthy economy with a strong job market. Prices at first rose fast thanks to supply shortages caused by the COVID-19 pandemic, and then the rapid recovery in consumer demand gave companies the power to keep lifting them even as the supply environment improved.

Now, though, the rate of consumer inflation is slowing following a series of large interest rate hikes from the Federal Reserve. But U.S. shoppers still feel the pinch of the increases in the cost of everyday goods over the last few years.

For instance, the inflation shock lifted housing and food costs to such a degree they are notably higher today than would have been expected had previous price trends held up. The inflation updraft was not quite universal, though: Medical services costs are now modestly below trend.

Recent quarterly earnings reports suggest Americans are reining in spending on big-ticket purchases due to higher rates, and are trading down to buy cheaper items because of costs. Against that backdrop, government data also shows a measure of margins for retailers and wholesalers has diminished sharply from very high levels when inflation was at its worst.

That said, overall operating margins for S&P 500 Index corporations - among the largest U.S. companies - remain above the pre-pandemic trend, but it is not the case across all sectors. Margins for companies providing communications services - everything from mobile phone contracts to home entertainment - are among the most elevated relative to the decade prior to COVID.

The Biden administration has accused companies of "shrinkflation," that is, keeping prices the same while reducing the volume of goods inside packaging - a boost to margins.

The Biden administration, along with several states, has argued that market share concentration in some sectors is one force limiting consumer choice and therefore aggravating inflation.

Indeed, the White House has intervened to try to stop a merger between grocery giants Kroger (NYSE:KR ) and Albertsons (NYSE:ACI ). Several states, mostly in the Western U.S., have joined the effort to kill the deal.

Source: Investing.com