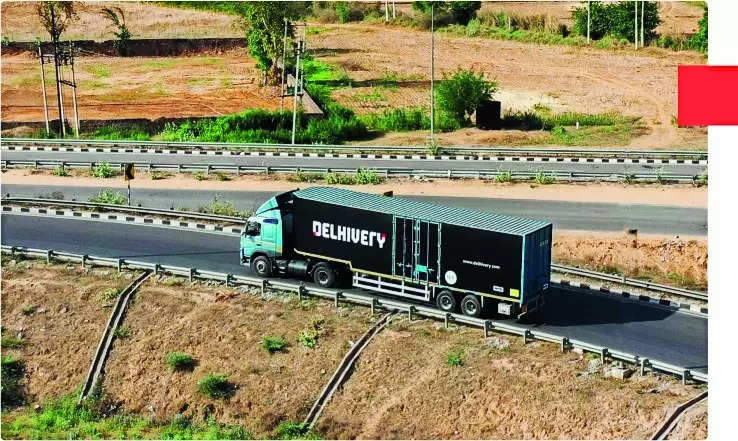

Brokerages bearish on Delhivery post Q4 nos, shares plunge 10%

"Margin improvement is volatile as the small impact on utilisation for its network impacts the margin as pricing power is limited," said the brokerage, while slashing its target price from ₹600 to ₹488.

Mumbai: of logistics solutions provider tumbled over 10% on Tuesday after the company's fourth-quarter results prompted some , including , to cut their on the stock. The price targets after the March imply a 15-74% upside in the stock from Tuesday's closing price of ₹390.CLSA downgraded its rating on to underperform from buy citing volatile growth in the .

" is volatile as the small impact on utilisation for its network impacts the margin as pricing power is limited," said the brokerage, while slashing its target price from ₹600 to ₹488.

Some analysts are, however, optimistic about the company's prospects. "We think that what happened with Delhivery was one-off event where we saw a knee-jerk reaction from the market to its results," said Hemang Jani, director, . "Its fourth quarter results have been good and the only vertical which was disappointing in terms of revenues and has been its express parcel service."

Shares of Delhivery were listed in May 2022 at ₹495.2 and have been trading below the listing price since October 2022.

retained its buy rating on Delhivery and raised its price target to ₹615 from ₹600 earlier.

"Delhivery surprised positively with strong turnaround in profitability based on strong incremental gross margins," said the firm. "Delhivery had 50% incremental gross margins in the transport business."

Jani is positive about the outlook of the company.

"The capex of the company has peaked out and most of its key clients have raised money and will continue their business with the company," said Jani. "We are positive on the company and have a buy rating along with a target price of ₹550."

Source: Stocks-Markets-Economic Times