Boeing strike poses challenge to MAX targets, supply chain, CFO says

By Allison Lampert and Abhijith Ganapavaram

(Reuters) - A strike beginning Friday by more than 30,000 of Boeing (NYSE:BA )'s U.S. West Coast factory workers will make it harder for the planemaker to meet a 737 MAX production target and stabilize its supply chain, CFO Brian West said on Friday.

West also told the Morgan Stanley Laguna Conference he expects third-quarter margins from the company's defense and space unit to be negative, similar to those in the second quarter.

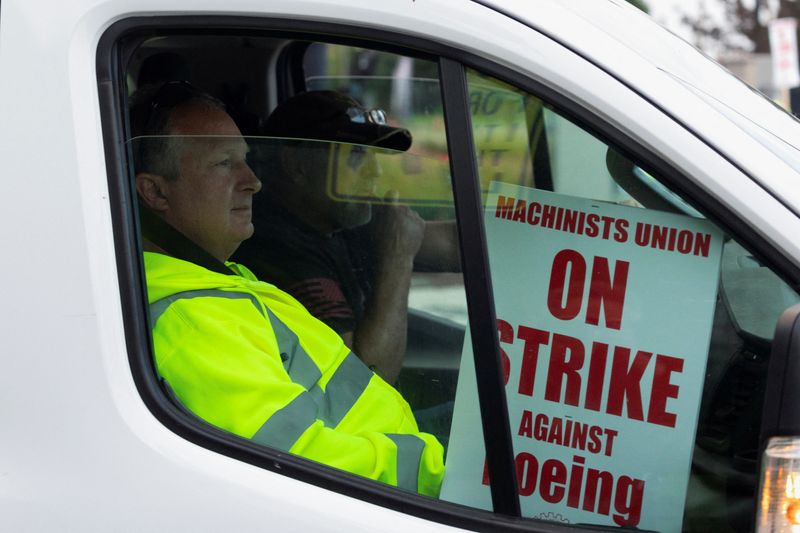

Workers from Seattle and Portland, Oregon, who produce the MAX and other jets walked off the job after overwhelmingly rejecting a contract deal due to demands for higher pay. The workers' first strike since 2008 comes as Boeing is under heavy scrutiny from U.S. regulators and customers after a door panel blew off a 737 MAX jet mid-air in January.

West said Boeing had made progress towards ramping production of its strongest selling jet back to 38 a month by year's end, despite earlier skepticism from rating agencies over the target.

"We've been making good progress on stabilizing production and preparing for that 38 per month by the end of the year. Now, obviously that's going to take longer," West said.

West, however, would not comment on specifics related to the target, which depends on the duration of the strike.

The strike is creating more uncertainty and concern for suppliers of parts and components for programs like the 737 MAX. Many were already having difficulty planning production due to Boeing’s repeated changes to internal forecasts for suppliers.

West said a company priority was stabilizing its supply chain, but that "objective just got harder."

West suggested Boeing would stop taking parts from some suppliers on programs impacted by the strike where the planemaker has ample inventory. The company's 787 widebody jet is not impacted, as it is built in South Carolina by a non-unionized workforce.

Asked about supply chain, West said for non-787 programs, if the supplier is not behind and the company has enough stock, "you know, don't deliver anymore."

He said this messaging is "happening overnight and as we speak."

Source: Investing.com