Auto component industry to double investment to $7 billion; Craftsman Automation could give 19% return

Auto component industry to double investment to $7 billion; Craftsman Automation could give 19% return. Premiumization trend drives shift to 'premium' vehicles. UV mix in PVs at 60% in FY24. 125cc+ segment in motorcycles at 52% in FY24. Social media influences rural trends. Finance accessibility boosts premiumization. India targets net zero emissions by 2070, promoting EVs and biofuels.

We are witnessing a noticeable shift in among consumers, who are willing to pay a ‘premium’ for additional features such as safety, driving experience, plush interiors, aesthetics, and comfort.The key buying parameter has shifted from fuel efficiency and ‘value for money’ to the aesthetics and overall appeal of the product for a large section of society.

Two trends that support this shift are the UV mix in PVs has now increased to 60% of sales in FY24 from 28% in FY19, and the proportion of the 125cc+ segment in overall motorcycles has increased to 52% in FY24 from 38% in FY19.

With the rising influence of social media on consumers, more and more people feel the urge to follow the latest trends or even set trends themselves.

Social media is also helping drive the latest lifestyles beyond metropolitan areas to Tier 2 and Tier 3 towns, as well as rural regions

Our channel checks suggest that these trends are now visible even in the rural parts of India, as the country’s youth do not want to purchase entry-level vehicles (cars or 2Ws).

In addition to the above, easy access to finance is driving the trend towards premiumization in India across various categories.

Given the tailwinds highlighted above, we believe this is here to stay in the long run.

To achieve its goal of net zero emissions by 2070, India submitted its long-term low-emission development strategy to the at in November 2022.

According to the strategy, apart from the push to increase electric vehicle (EV) adoption, there is also an emphasis on the increased use of biofuels, particularly ethanol blending in petrol, and the rising use of .

The government has also earmarked a to reduce emissions. As per recent reports, they are looking to support hybrids as well. We believe this approach is appropriate, considering the country's demographics.

The domestic appears to be in a sweet spot as several tailwinds converge to drive a sustainable long-term growth opportunity.

These include the emergence of the as one of the beneficiaries of the supply chain de-risking strategy by global OEMs, following the continued supply chain disruptions over the last 3-4 years.

The outperformance of the core industry is likely to continue, driven by rising content due to premiumization and the transition to EVs, favorable government policies that advocate ‘Make In India’; and the emergence of India as an auto hub for global OEMs.

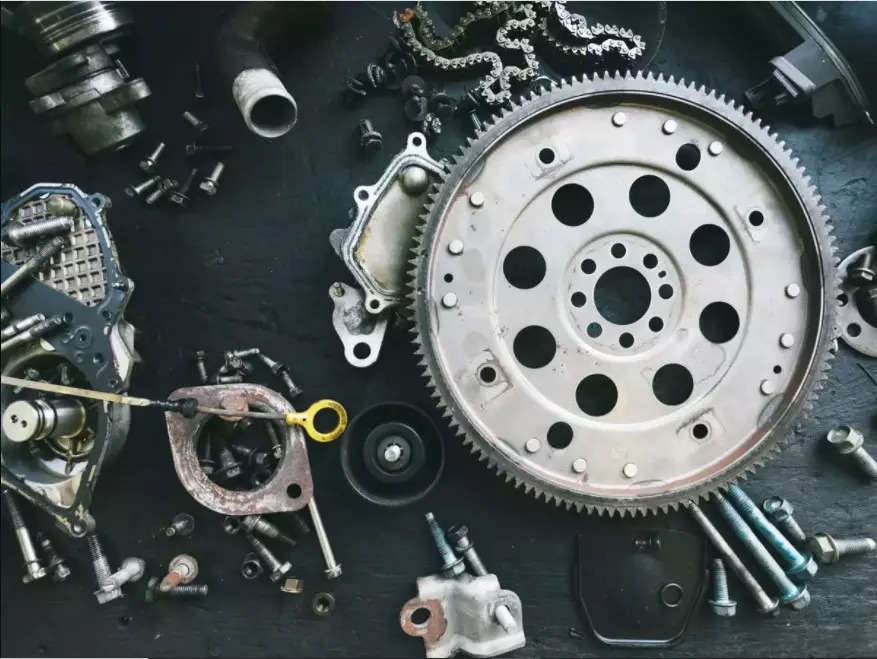

Given the above trends and its inherent core strengths (global quality at low cost + improving R&D skills), the auto component industry is expected to invest around USD6.5-7.0b over next the five years, which is double what it invested in the previous five years.

Given these tailwinds, we see tremendous growth opportunities for the domestic auto component industry in the coming years.

: Buy| Target Rs 5,320| LTP Rs 5,102| Upside 4%

We expect Hero to deliver a volume CAGR of 9% over FY24-26E, driven by new launches and a ramp-up in exports. It will also benefit from a gradual , given strong brand equity in the economy and executive segments.

: Buy| Target Rs 5,305| LTP Rs 4,447| Upside 19%

We expect Craftsman to post a healthy 15% revenue CAGR over FY24-26 driven by healthy order wins across segments and a well-diversified mix.

Management expects (off highway + Industrial Engineering) to deliver $100m incremental revenue over the next 4-5 years. The aluminum casting business is expected to grow 15%+ fuelled by healthy growth in both standalone and .

ETMarkets.com

ETMarkets.com(The author is Head – Retail Research, Motilal Oswal Financial Services)

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the )

Source: Stocks-Markets-Economic Times