Auto battery makers shine on EV prospects

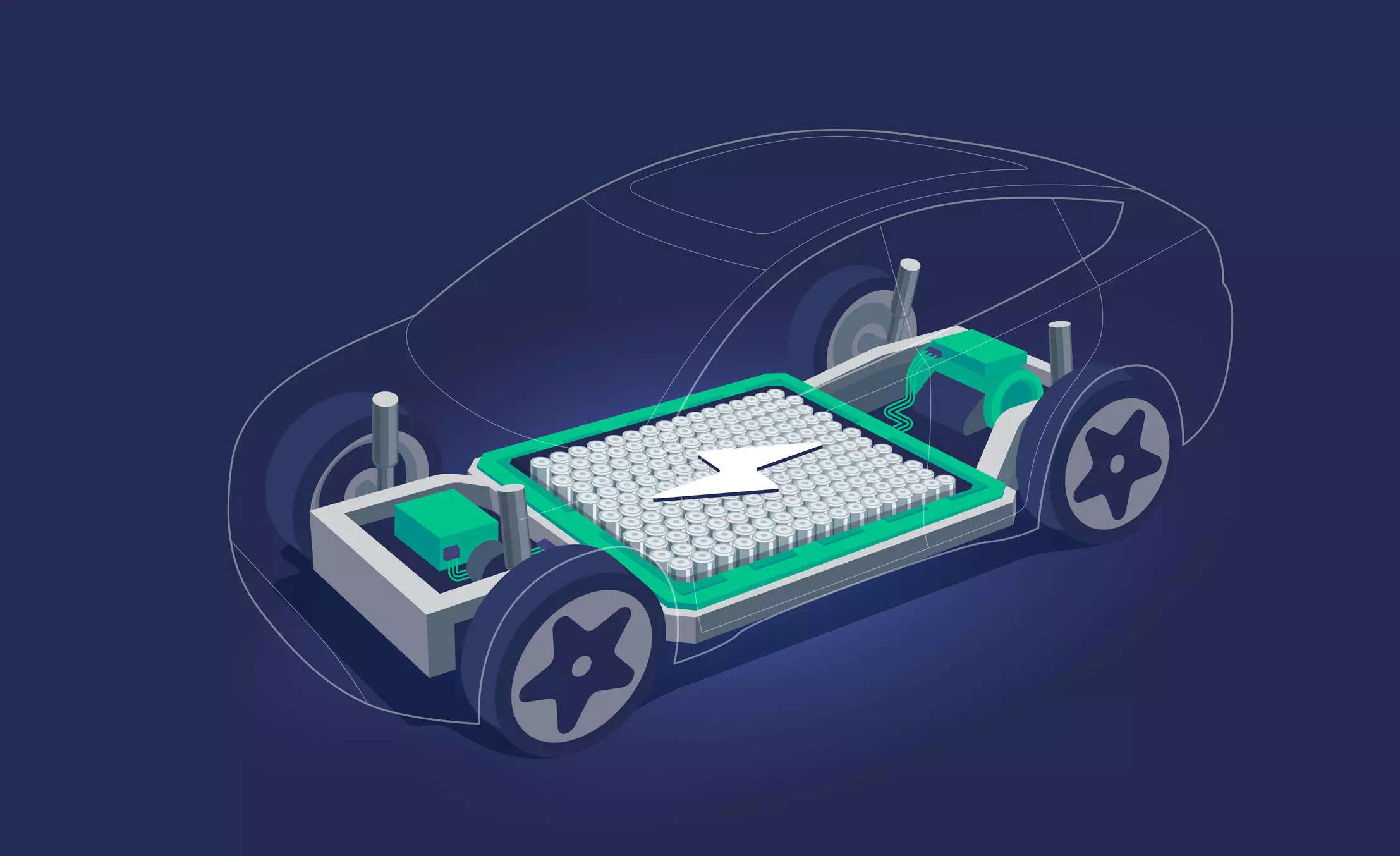

Exide and Amara Raja stocks soared due to increasing EV demand. Analysts foresee bright prospects for Exide with Hyundai and KIA partnership, government aid, and EV market growth. The companies are set to capitalize on the rising trend.

Mumbai: Shares of automobile battery makers such as and and Mobility surged to their one-year highs on Tuesday, sparked by hopes that the push for localised electric vehicle (EV) manufacturing could drive demand for their products.Analysts said Exide's partnership with Hyundai and KIA and the government's impetus for making EVs in the country has improved growth prospects for battery-making companies.

"Exide's partnership with Hyundai and KIA to expand localised manufacturing and the government's strong plans for EV space are propelling the demand for ," said Sneha Poddar, associate vice president- equity research, .

"This means that Exide is likely to benefit from this partnership."

Exide soared 15% and Amara Raja jumped 10.7%. Analysts said that the capex by both companies for the lithium-ion battery segment has been strong and Exide's partnership has validated the spending.

"Exide's tie-up with Hyundai and KIA has led to the validation of the EV battery-making ecosystem," said Pankaj Pandey, head of research at ICICI Securities. "The company is likely to benefit from sustainable future cash flows due to improved credibility of the new EV business."

Pandey said that both companies are venturing into the lithium-ion battery space, which is a sunrise sector.

Exide and Amara Raja Energy and Mobility are the two most prominent players in the auto battery manufacturing segment with market cap of ₹39,984 crore and ₹17,680.25 crore, respectively.

"The traction in and Amara Raja Batteries has been due to the growth expectations in the EV segment since these two companies have the majority of market share, they stand to benefit the most," said Poddar.

With Tesla planning to set up in India, the demand for EVs is expected to move up and the government's Production Linked Incentives (PLI) schemes support the rising demand for battery makers.

Brokerages remain bullish on Exide Industries and expect the tie-up with global players, government support, and traction in the EV segment to benefit the company

"In our view, this provides significant validation to Exide's cell development as Hyundai and KIA are already selling EVs in the global market and plan to launch many EVs in India," said Nomura in a note.

Morgan Stanley said that Exide is likely to benefit from the government's support for Made in India EVs, strong auto and industrial customer tie-ups, tech tie-ups, and an early-mover advantage.

"Exide's share price could rise significantly over the next 10 years, as it could become a leading player in battery cell localisation," said the brokerage in a note.

"A re-rating in the battery manufacturing segment is likely since the valuations were cheaper previously, and the companies can fetch higher values as there is scope for further upside potential," said Pandey.

Source: Stocks-Markets-Economic Times