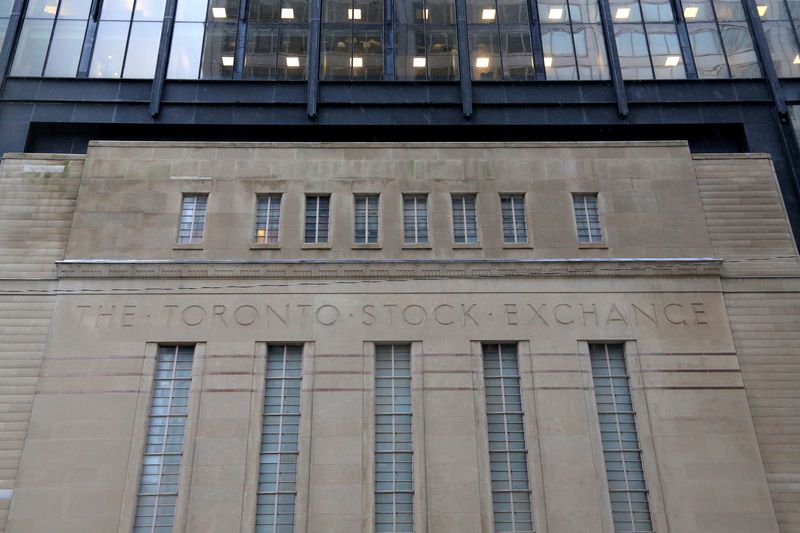

TSX hits record high on energy boost; Powell's speech awaited

By Nikhil Sharma

(Reuters) -Canada's main stock index touched a record high on Thursday, helped by energy stocks, while investors digested a mixed batch of U.S. economic data and awaited Federal Reserve Chair Jerome Powell's comments due later in the day.

The S&P/TSX composite index was up 77.54 points, or 0.31%, at 25,066.56, set for a fourth consecutive session of gains.

The energy sector rose 2.2% as oil prices gained over 1%, after declining earlier this week on a stronger U.S. dollar and worries about rising supply amid slow demand growth. [O/R]

The heavyweight sector also benefited from a 13.4% jump in Paramount Resources (OTC:PRMRF )' shares, after shale producer Ovintiv (NYSE:OVV ) announced a $2.38 billion all-cash deal to acquire the energy firm's oil assets.

In contrast, the technology sector limited overall gains with a 1.6% fall, retreating after seven straight sessions of gains.

Materials shares added 0.9%, despite lower gold prices.

"I wouldn't call it a strong rally," said Macan Nia, co-chief investment strategist at Manulife Investment Management, adding markets were digesting the two data points that will be "driving market performance throughout the day."

Wall Street's main indexes edged lower in choppy trading on Thursday, following the release of the monthly producer prices data. [.N]

U.S. producer prices were up in October due to higher costs for services such as portfolio management and hospital outpatient care, suggesting progress toward lower inflation was stalling.

Separately, U.S. weekly jobless claims fell last week, indicating the labor market continued to chug along.

Traders see a 78.9% chance of a 25-basis-point interest-rate cut at the Fed's December meeting.

Investors are now focused on Powell's speech for possible remarks on how far and fast the Fed will lower policy rates, given the market expectations that Donald Trump's policies could stoke inflation and obstruct the Fed's path to lowering rates.

Source: Investing.com