Stocks down as Treasury yields gain; traders weigh tariffs, Fed rate cuts

By Chibuike Oguh and Alun John

NEW YORK/LONDON (Reuters) -A global bond selloff continued on Wednesday, pressuring stock prices and boosting the dollar as signs of continuing strength in the U.S. economy dimmed expectations for aggressive near-term interest rate cuts.

The benchmark 10-year U.S. Treasury yield rose as high as 4.73%, a peak since April 2024, building on Tuesday's 7 basis point rise. It was last up 0.4 basis points to 4.695%.

"Going into this first quarter that we're in right now, aside from earnings, I think a big risk for equities is if bond yields do get to 5%," said Mark Malek, chief investment officer at SiebertNXT in New York. "Buyers are going to be a little bit more reticent. So the people that were powering the market higher, the bid is going to weaken."

The selloff in bonds on Wednesday accelerated after a CNN report that U.S. President-elect Donald Trump is considering declaring a national economic emergency to provide legal justification for a series of universal tariffs on allies and adversaries.

On Wall Street, the benchmark S&P 500 was flat, the Dow rose, while the Nasdaq was trading lower in choppy trading with utilities, energy and communication services driving losses. Healthcare and industrials equities were among the biggest gainers.

The Dow Jones Industrial Average rose 0.06% to 42,553.38, the S&P 500 rose 0.01% to 5,909.53 and the Nasdaq Composite fell 0.12% to 19,466.47.

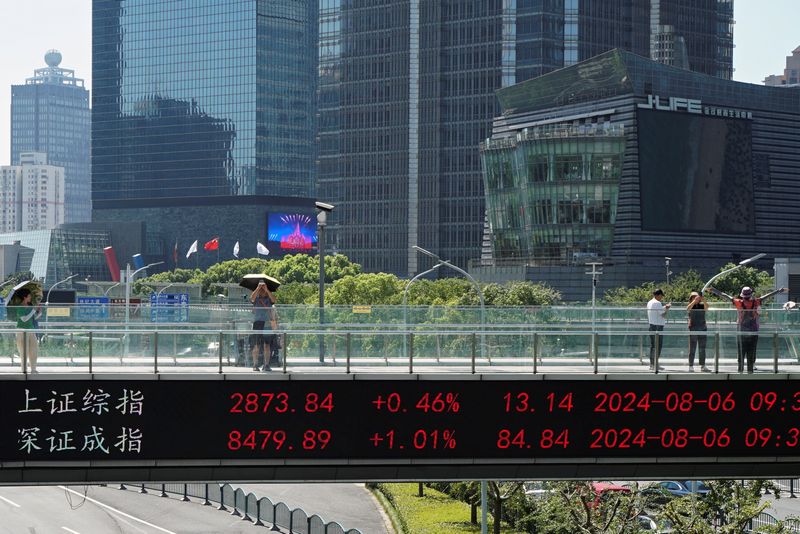

European shares dipped, with the pan-European STOXX 600 finishing down 0.2%, with most regional bourses also in the red. MSCI's gauge of stocks across the globe fell 0.22% to 845.05.

European government bond yields surged, with those on German benchmark 10-year notes hitting their highest in about six months. The British 10-year gilt yield rose over 11 basis points to 4.82%, the highest since 2008.

Strong U.S. economic data have weighed on U.S. Treasuries in recent weeks, with investors scaling back expectations for Federal Reserve rate cuts.

Markets are only fully pricing in one 25-basis-point rate cut in 2025, and see around a 60% chance of a second.

Investors will watch Friday's more comprehensive non-farm payrolls data after data on Wednesday showed a lower than expected increase in private payrolls and jobless claims.

"One thing I'm worried about is, this bonfire of yields going higher tends to reinforce each other, particularly at times like this," said Michael Purves, CEO and founder of Tallbacken Capital Advisors. "I'm concerned about is if you can buy a 10-year Treasury at 5% with zero risk and that's a higher yield than on the S&P 500 that's going to beg a lot of asset allocation questions."

The dollar index , which measures the greenback against a basket of currencies including the yen and the euro,rose 0.35% to 109.08, with the euro down 0.28% at $1.031.

Oil prices were pressured by a stronger dollar and large builds in U.S. fuel inventories last week. Brent crude settled down 89 cents, or 1.16%, to $76.23 a barrel. U.S. West Texas Intermediate crude fell 93 cents, or 1.25%, to $73.32.

Gold prices advanced. Spot gold rose 0.32% to $2,657.89 an ounce. U.S. gold futures settled 0.3% higher at $2,672.40.

Source: Investing.com