US to decide on another round of solar panel tariffs

(Reuters) - U.S. trade officials are expected to announce on Friday a new round of tariffs on solar panel imports from four Southeast Asian nations after American manufacturers complained that companies there are flooding the market with unfairly cheap goods.

It is the second of two preliminary decisions that President Joe Biden's Commerce Department is making this year in a trade case brought by Korea's Hanwha Qcells, Arizona-based First Solar Inc (NASDAQ:FSLR ) and several smaller producers seeking to protect billions of dollars in investments in U.S. solar manufacturing.

This is the latest chapter in a more than decade-long trade war with Chinese companies over their solar dominance. Chinese manufacturers have responded to U.S. solar tariffs by moving their massive operations to nations where they will not face duties - including Southeast Asia.

The group, the American Alliance for Solar Manufacturing Trade Committee, accused big Chinese solar panel makers with factories in Malaysia, Cambodia, Vietnam and Thailand of causing global prices to collapse by dumping products into the market.

The Hanwha-led group has sought antidumping duty rates of between 70.35% and 271.45%, depending on the country, to offset the unfair pricing. It also has sought tariffs to combat unfair subsidies in those nations, and the Commerce Department imposed preliminary antisubsidy duties last month.

Most solar panels installed in the United States are made overseas, and some 80% of imports come from the four nations targeted in the Commerce Department probe.

Tariffs would increase prices for companies that import panels to install on rooftops or build solar power plants, but the United States over more than a decade has shown a willingness to impose duties on the sector in a bid to bolster the small U.S. clean energy manufacturing industry.

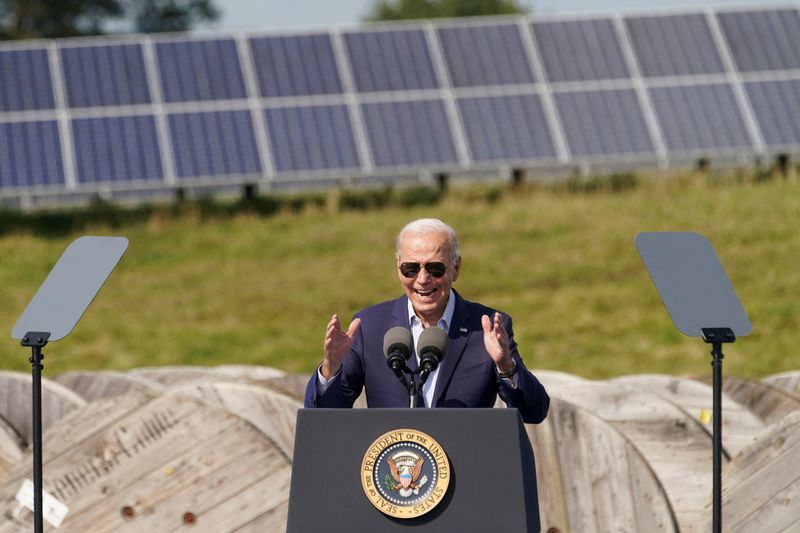

The Biden administration this year raised the alarm over China's massive investment in factory capacity for clean energy goods. Biden's landmark climate change law, the Inflation Reduction Act, includes incentives for companies that produce clean energy equipment in the United States - a subsidy that has prompted a flurry of plans for new solar factories.

President-elect Donald Trump has called the Inflation Reduction Act too expensive, but also has said he plans to slap hefty tariffs on a range of sectors to protect American workers.

Dumping occurs when a company sells a product in the United States at a price below its cost of production or lower than what it charges in its home country.

Source: Investing.com