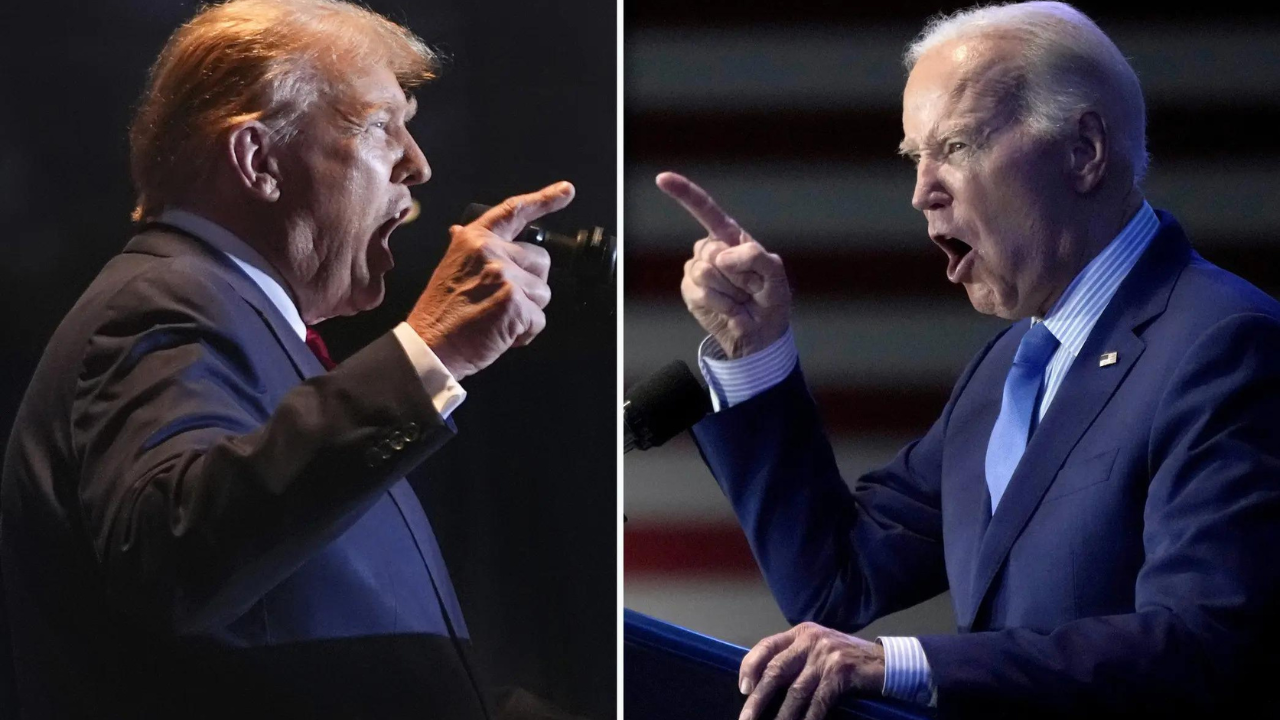

US Election Showdown 2024: Trump-Biden face-off and its effects on dollar and equities

A political showdown between Donald Trump and Joe Biden sets up a high-stakes battle in the US. With economic growth, inflation, and job statistics at play, the fate of the dollar and equities hangs in the balance.

Following the recent elections in India which took markets on a ride, the political spotlight has now shifted across the Atlantic, as the US braces for a high-stakes showdown between Donald Trump and Joe Biden on November 5.Let's dive into the turbulent waters of the political landscape to explore what's at stake, who is likely to rise to power, and what implications these shifts might have on currency markets.

The world's most influential economy- The United States

Although the United States is set to hold its elections at the end of the year, being the world's largest economy ensures that all eyes are on it. With Biden's term drawing to a close, it's gearing up for round two of Trump vs. Biden, in what many are calling an "even closer election" than the last.

To set the stage, the two main political parties in the US are the Democratic Party and the Republican Party. Joe Biden is contesting from the Democratic side while Donald Trump represents the Republicans. After their recent showdown in the first presidential debate, Trump is leading Biden with 41% to 38% in the polls, following a previous survey that showed a neck-and-neck race at 37% each.

Both Biden and Trump administrations oversaw periods of robust growth.

Economic growth

Since Biden's inauguration, the gross domestic product (GDP) has increased by 8.4 percent when adjusted for .

Under Trump, GDP grew by 6.8 percent, despite the significant plunge in economic activity during the first year of the pandemic.

Inflation

Since Biden took office, prices have risen by more than 19 percent, with his tenure marked by far higher inflation compared to Trump's, driven by factors such as COVID-related supply chain disruptions.

At a similar point in Trump's presidency, prices had only risen by about 5 percent. Although inflation has decreased sharply since peaking at 9.1 percent in mid-2022, it remains stubbornly high. The consumer price index last month stood at 3.3 percent, well above the US ’s target of about 2 percent.

Jobs & Wages

Under Biden, unemployment fell to a 53-year low of 3.4 percent in January last year and has remained below 4 percent for all but one month since then. However, US workers have seen their earnings decline in real terms due to inflation.

Excluding 2020, Trump oversaw a period of low unemployment, with the jobless rate hitting a low of 3.5 percent in late 2019. Wage growth under Trump stayed above inflation, delivering modest rises in workers’ incomes.

’s performance

In most cases, the DXY (dollar index) tends to exhibit varied volatile movements, sometimes declining (e.g., 2004, 2020) or rising (e.g., 2016, 2012) in the six months before the election. Whereas, there is often a stabilisation or minor fluctuation post-election, compared to the volatility leading up to it.

However, the DXY performed exceptionally well in 2008 likely due to the combination of safe-haven demand, perceptions of US economic stability under a new administration, and global economic conditions during the financial crisis.

Agencies

AgenciesFor S&P 500

It tends to show positive gains from six months before the election to six months after, regardless of the winning party. There is often a notable increase in the index from Election Day to six months after, reflecting market optimism post election certainty. Economic conditions and external factors like crises can significantly influence these trends, as seen in 2008.

However, in 2020, there were expectations that a Biden administration would prioritise fiscal stimulus measures to support the economy, especially amid the COVID-19 pandemic. This anticipation of increased government spending and economic support measures had positively impacted stock prices.

Agencies

AgenciesWhat is the fate of DXY and this year?

As we navigate through 2024, the interplay between the Federal Reserve's monetary policy, the resilience of the US economy, and political developments will be crucial in shaping the performance of both equities and the DXY.

The anticipation of interest rate cuts by the Federal Reserve, coupled with a robust economic backdrop, is likely to provide a favourable environment for equities. At the same time, these same factors may exert downward pressure on the DXY, leading to a potential decline in the value of the US dollar.

Thus, for now, considering the overall scenario, the S&P 500 stands at an all-time high, buoyed by expectations that the Federal Reserve will cut interest rates later this year while the economy remains resilient.

Anticipation of Fed easing has also driven down DXY and the same could remain under pressure. Well, the range for DXY for the remaining part of the year could be 102 to 107 with overall biases on the downside despite being in an election year.

(The author is MD, CR Forex Advisors)

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)

Source: Stocks-Markets-Economic Times