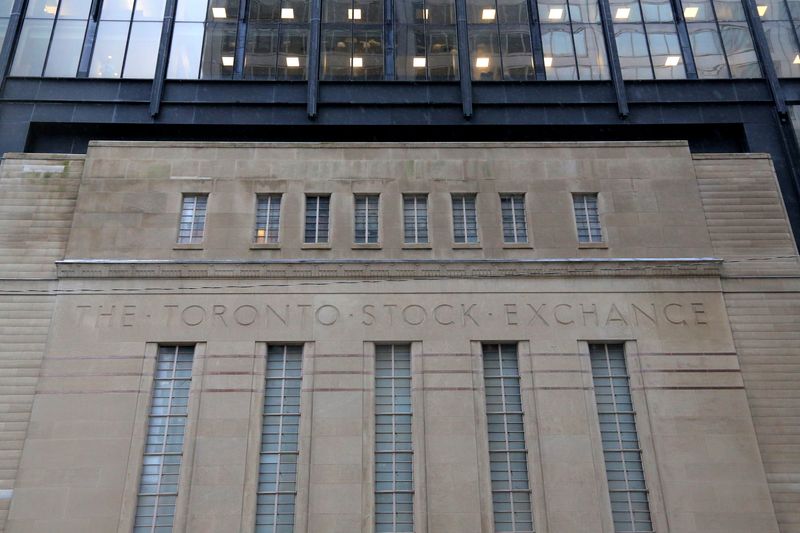

TSX hits three-week high amid rally fueled by Trump's reelection

By Nikhil Sharma

(Reuters) -Canada's main stock index hit a three-week high on Monday (NASDAQ:MNDY ), led by technology and financial shares, as markets continued to rally on Donald Trump's reelection in the United States.

The S&P/TSX composite index was up 107.4 points, or 0.43%, at 24,866.8, hovering near a record high last hit on Oct. 21.

The technology sector led the overall gains with a 1.7% jump, buoyed by blockchain-farm operator Bitfarms's shares that climbed 10.5% after Bitcoin soared to a record high above $82,000.

Heavyweight financials and rate-sensitive utilities shares were also among the top gainers, rising 1.1% each.

"This is just a continuation of the Trump rally," said Ian Chong, portfolio manager at First Avenue Investment Counsel.

There is "still a lot of optimism regarding economic growth with Trump's pro-growth policies."

Trump's victory kicked off a global stock market rally last week over market anticipation of equity-boosting tax cuts and looser regulations by the new administration.

However, Canada could be impacted by Trump's proposed 10% tariff on imports as it sends about 75% of its exports to the United States, including oil.

The materials sector fell 3.2% after gold prices declined, dragged by a firmer dollar and increased risk appetite as markets expect the Federal Reserve to adopt a cautious policy easing approach under Trump's administration. [GOL/]

Copper prices slipped after new bank lending in China fell more than expected in October. [MET/L]

Investors this week will focus on the U.S. consumer price index that could provide more clues about the Fed's monetary policy move at its December meeting.

In Canada, quarterly earnings from Shopify (NYSE:SHOP ) will grab market attention on Tuesday. The e-commerce services giant was the second-biggest gainer on the index, having risen 3.5%.

Meanwhile, the Montreal Longshoremen's Union rejected the final offer made for a new labour contract, leading to a lockout declaration.

Source: Investing.com