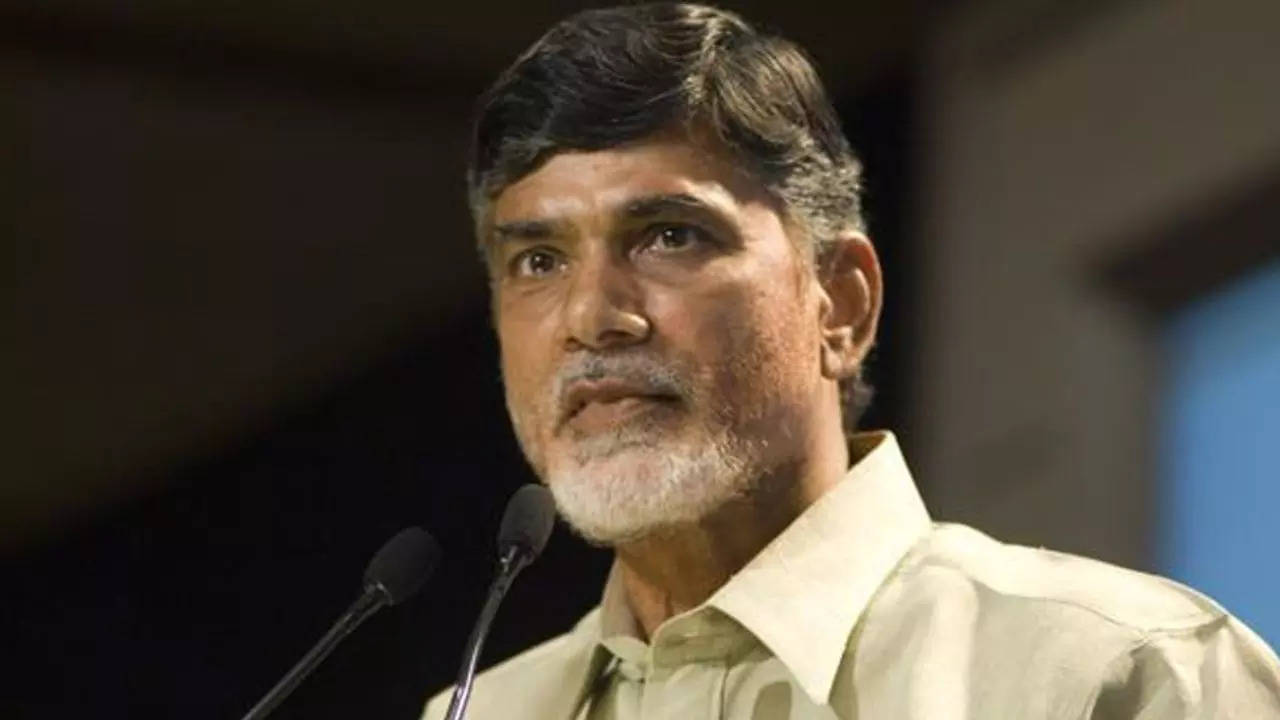

These Chandrababu Naidu-linked multibaggers surge up to 230% in a year. Is there still time to ride these bulls?

Chandrababu Naidu-linked stocks, Amara Raja Energy & Mobility and Heritage Foods, have surged up to 230% in the past year as TDP won assembly elections. Analysts are bullish on these stocks.

Analysts seem to be bullish on the , Amara Raja Energy & Mobility and , whose prices have increased by 124% and 230% respectively in the last one year and have come into limelight as won the assembly elections.Heritage Foods has experienced a remarkable surge of over 105% in its stock price over the past 12 trading sessions alone while Amara Raja Energy, whose Managing Director Jay Dev Galla was a former MP from TDP (Telugu Desam Party), has seen its shares rally over 20% post Naidu-led TDP securing a win in the assembly elections.

Analysts say the stock has more upside left notwithstanding the rally seen in the past few days. Here is what they have to say:

Amara Raja Energy & Mobility

“The battery-related stock has witnessed strong traction in the last few months, and we believe the bullish tone will continue ahead. This stock has witnessed a multi-year breakout from the consolidation range on the back of strong volumes, which indicates a bullish tone to continue,” said Rohan Shah,Technical Analyst at Religare Broking.

Technically, Shah stated that by applying the Fibonacci retracement tool, stock has more upside steam left and has the potential to test Rs 1,600 levels in the coming weeks. Thus, he feels that any dips towards the support zone of the Rs 1,350- Rs 1,330 zone should be considered a fresh buying opportunity with a stop below Rs 1,280 levels on a closing basis.

While being cautious about the risks associated with the sector, Arun Agarwal, VP & Analyst, Fundamental Research, Kotak Securities said that the lead-acid business performance is expected to remain steady in the medium term as the EV transition is likely to take place in a phased manner.

Shift towards the lithium battery business however, is a risk over the long term. The company is working in that direction and is in the process of commencing construction activities of Gigafactory, added Agarwal.

The Amara Raja stock has given a range breakout on daily charts and is trading at life time high while forming a higher top - higher bottom from last 4 trading sessions, which is an indicator of buying from lower zones and supports are gradually shifting higher.

It is also trading above its key moving averages and momentum indicator RSI has given bullish crossover which may support on going up move.

“We have seen buying interest in the entire sector which also supports the positive price setup of the stock. As per the technical structure momentum could continue with support of Rs 1,300 zones for a fresh rally towards Rs 1,600 zones,” said Chandan Taparia, Senior VP, Equity Derivatives & Technicals, Broking & Distribution at Motilal Oswal.

The shares of Amara Raja closed flat at Rs 1,401.25 on BSE today.

Heritage Foods

Heritage Foods witnessed a vertical rally and rallied almost over 70% in the last few sessions, hitting a new record high.

“The sharp rally in the stock has led the momentum oscillators to turn highly overbought. Also, following the Fibonacci retracement levels, the stock has hit the 161.8% external retracement line, which coincides around Rs 720 levels,” stated Rohan Shah, Technical Analyst at Religare Broking.

He further said he believes that traders should avoid taking any fresh entry and, in fact, can consider booking some gains here, and for the remaining to trail stop losses below Rs 660 levels.

Heritage Foods has a direct connection to the TDP, as it is promoted by Nara Lokesh, son of TDP chief Chandra Babu Naidu.

The stock of Heritage Foods has surged 128% in the current calendar year while gaining 91% in the last 2 weeks.

The shares of Heritage closed 5% higher on BSE today to Rs 694.15.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)

Source: Stocks-Markets-Economic Times