Senator Warren urges Fed to keep Wells Fargo asset cap

By Pete Schroeder

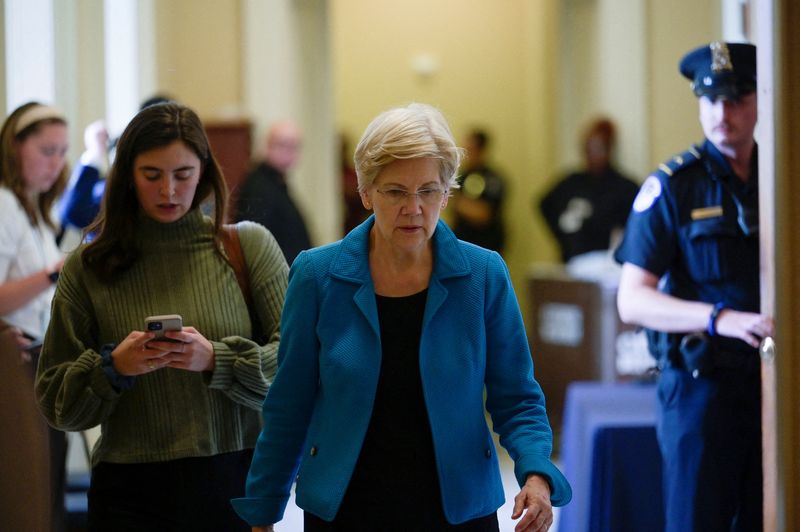

WASHINGTON (Reuters) - The Federal Reserve must not remove Wells Fargo (NYSE:WFC )'s $1.95 trillion asset cap until the bank has fixed its risk management and compliance issues, top Democratic Senator Elizabeth Warren told the U.S. central bank on Wednesday.

In a letter to Fed Chair Jerome Powell and the central bank's regulatory chief, Michael Barr, Warren said the Fed must reject Wells Fargo reported appeal to have the punishment imposed in 2018 lifted until it "can show that it can properly manage the risks associated with running a large bank."

Spokespeople for Wells Fargo and the Fed declined to comment on the letter, which was seen by Reuters.

Bloomberg reported in September that Wells Fargo had sent a third-party review of its risk and control overhauls to the Fed in a bid to end the unprecedented cap imposed following the bank's long-running fake accounts scandal and other issues.

Republican President-elect Donald Trump is set to overhaul bank regulation and slash burdensome rules, boosting analysts' expectations that the cap could be removed as early as next year and alarming many Democrats in favor of tough rules.

A prominent Wall Street critic and one-time presidential candidate, Warren will next year become the top Democrat on the Senate Banking Committee. Long a thorn in Wells Fargo's side, Warren cannot force the Fed's hand but her letter can pressure it to take a tough line and highlight the bank's missteps.

Warren pointed to a number of regulatory actions against Wells Fargo since 2018, including in September when the Comptroller of the Currency dinged the bank for shortcomings in policing money laundering. The country's fourth-largest lender is still grappling with a class action lawsuit over its diversity hiring practices, she also noted.

Wells Fargo CEO Charlie Scharf has repeatedly said upgrading the bank's risk and control framework has been a top priority, and the bank has convinced regulators to terminate six regulatory consent orders since 2019.

In response to Warren's request at a 2018 hearing, Powell committed that the Fed would put any decision to lift the asset cap to a vote of its Board of Governors. On Wednesday, Warren reminded him of that promise and called on the Fed to make public any third-party review Wells submitted as part of its bid to lift the cap.

Source: Investing.com