Paulson exits race for US Treasury Secretary, Bessent in focus

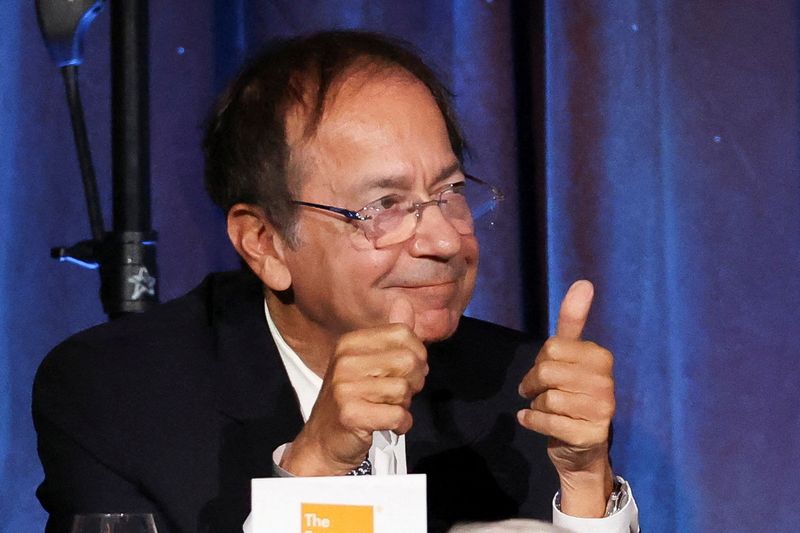

(Reuters) - Billionaire investor John Paulson said on Tuesday he was dropping out of contention for U.S. Treasury Secretary in Donald Trump's new cabinet, putting the focus squarely on fellow investor Scott Bessent, the other main candidate in the race.

Paulson, who had been one of the frontrunners for the role under President-elect Trump, said on Tuesday his "complex financial obligations" will prevent him from holding an office in the new administration.

"I intend to remain actively involved with the president's economic team and helping in the implementation of President Trump's outstanding policy proposals," Paulson said in a statement. The Wall Street Journal earlier reported the statement.

Wall Street has been closely watching Trump's plans for the Treasury Secretary role, especially as he has said he plans to reshape global trade through tariffs.

Paulson and Bessent had emerged as the top contenders for the crucial job, which has vast influence over economic, regulatory and international affairs, sources said on Friday.

Both were financial backers of Trump's campaign.

A longtime hedge fund investor who taught at Yale University for several years, Bessent has a warm relationship with the president-elect and has spoken highly of Trump's use of tariffs as a negotiating tool. Paulson, a billionaire investor and major Trump donor, is a longtime proponent of tax cuts and deregulation.

Representatives for Bessent did not immediately respond to a request for comment.

The president-elect, who is set to return to the White House in January, has begun the process of choosing a cabinet and selecting high-ranking administration officials.

Professional wrestling magnate and former Small Business Administration director Linda McMahon is being viewed as the frontrunner to lead the Department of Commerce, while Susie Wiles, one of Trump's two campaign managers, has been picked to be his White House chief of staff.

Source: Investing.com