IT stocks slump as F&O bears mount bets on more downside fears, Infy results in focus

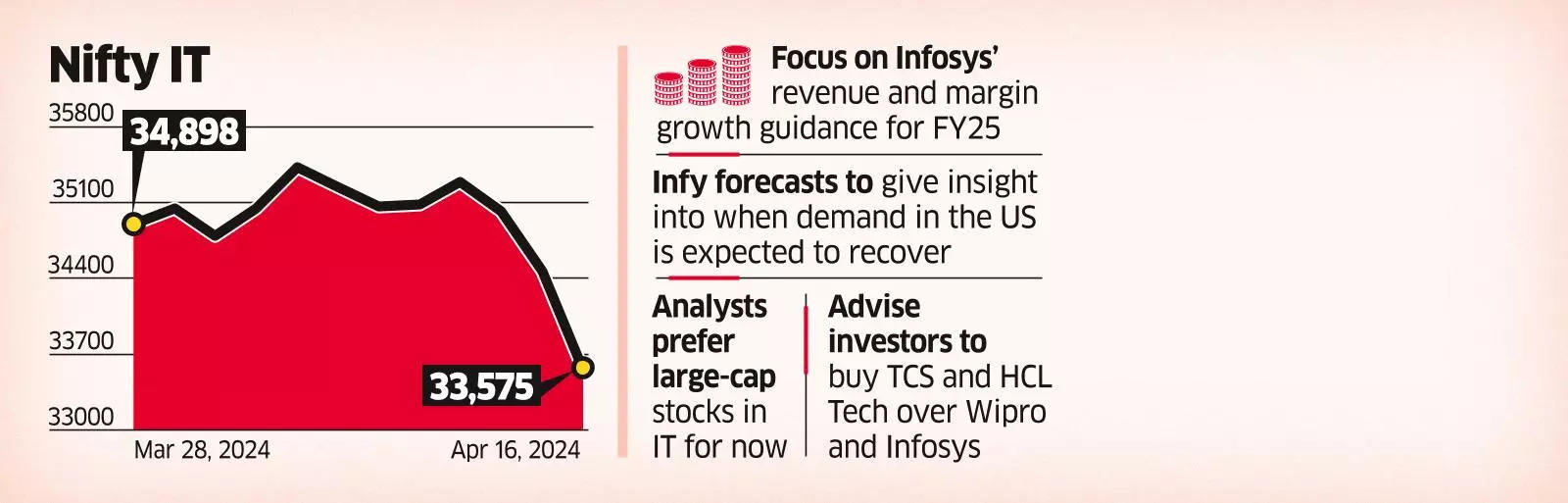

Indian IT stocks decline, affecting benchmarks. Concerns over US Fed rates and IT demand recovery persist. Infosys' guidance for FY25 awaited. Market cautious pre-results, with Nifty IT Index closing below 200 EMA.

Mumbai: Shares of Indian information technology (IT) companies slumped on Tuesday, dragging the benchmark indices lower, as traders built fresh bearish derivative bets on some stocks ahead of ' fourth-quarter results on Thursday.Concerns that the may not cut interest rates in a hurry, which may delay demand recovery for IT services, also weighed on sentiment.

Financial markets are shut on Wednesday for Ram Navami.

The tumbled 2.6% on Tuesday to 33,574.9, while the benchmark fell 0.6%. Infosys was the top loser, dropping 3.6%. declined 3.1%, fell 2.3% and ended 2.1% lower.

THE ECONOMIC TIMES

THE ECONOMIC TIMESThe drop in the stocks also resulted in the Nifty IT index closing below its 200 exponential moving average (EMA) - a key long-term trend indicator - of 33,900 for the first time since October, resulting in traders turning cautious. When a stock or an index closes below its 200 EMA, it is seen as bearish. "If the index sustains below this level, it indicates a medium- to long-term downtrend in the sector," said Ruchit Jain, lead research analyst at brokerage 5Paisa.com

Foreign Portfolio Investors were net sellers of Indian stocks to the tune of ₹4,468 crore, while their domestic counterparts were buyers worth ₹2,040 crore.

Investors are watching out for ' revenue and margin growth guidance for FY25. The forecasts will give some insight into when demand in the US is expected to recover.

"We see to be a market performer because there will be nothing special coming up in the results in the coming days," said Apurva Sheth, head of research at Samco Securities. "IT had been undervalued earlier after which it has bounced back and is now going through a consolidation phase."

5Paisa.com's Jain said there was fresh build-up of bearish derivative bets in LTI Mindtree, Infosys, Mphasis, Wipro and Info Edge on Tuesday.

Analysts predicted short-term gains in after the company's fourth-quarter results announced on Friday were better than expected. However, the stock fell on Monday and Tuesday amid the weakness in the broader market triggered by the Iran-Israel conflict.

"The fall in IT stocks is a result of increased geopolitical risks and has to do with valuation multiples," Apurva Prasad, VP- institutional research (IT), HDFC Securities. "We think that growth and margins for the sector have bottomed out."

Interest rate cuts by the US Fed are seen as one of the biggest triggers for IT stocks in India.

Sheth advises investors to stick to large-cap stocks in IT. "We are not very bullish on the overall market and would advise investors to prefer TCS and HCL Tech over Wipro and Infosys in the space," he said.

The activity in IT stock options contracts suggests limited upside from current levels.

"There was call writing seen at higher levels in options data and call writers look more active than put writers in the space," said Jain.

Source: Stocks-Markets-Economic Times