Fed unlikely to cut rates in early 2025, caution advised

As the Federal Reserve is expected to hold interest rates steady in the first half of 2025, Nigel Green, CEO of deVere Group, is advising investors to exercise caution and consider adjusting their portfolios accordingly. This guidance comes in the wake of continued inflationary pressures, a strong US labor market, and anticipated fiscal policies from President-elect Trump's administration, which are likely to keep the Federal Reserve from reducing rates in the near term.

Despite earlier market expectations for a rate cut by the Fed, possibly as soon as December, recent data indicates persistent inflation as a significant concern. The US Consumer Price Index (CPI) for November indicated a rise to 2.7% over a 12-month period, an increase from October's figures, with core inflation remaining at 3.3%. These statistics highlight the ongoing price pressures, suggesting that inflation is not as controlled as previously thought, which in turn could limit the Fed's ability to implement looser monetary policies.

The robust US job market adds to the complexity, with unemployment rates near historic lows and wage growth potentially keeping inflation high into 2025. Green states, "We’re entering a phase where inflation remains a persistent threat, and interest rates are unlikely to come down as quickly as markets had hoped." He emphasizes the need for investors to prioritize quality assets, build up inflation-resistant positions, and adopt a more defensive investment strategy.

Green also points out the growing market pressure on the Federal Reserve to ease monetary policy to support economic growth. However, he cautions that policymakers must avoid further increasing inflation, especially with President-elect Trump's proposed agenda, which could include tax cuts, deregulation, and significant infrastructure spending, expected to boost inflation in the upcoming months.

Green outlines four key considerations for investors during this time. He suggests looking into bond market opportunities, stating that fixed income assets, such as long-term government and corporate bonds, may offer stable returns. He also advises focusing on quality equities, particularly companies with strong balance sheets and proven pricing power, to withstand higher borrowing costs and inflation.

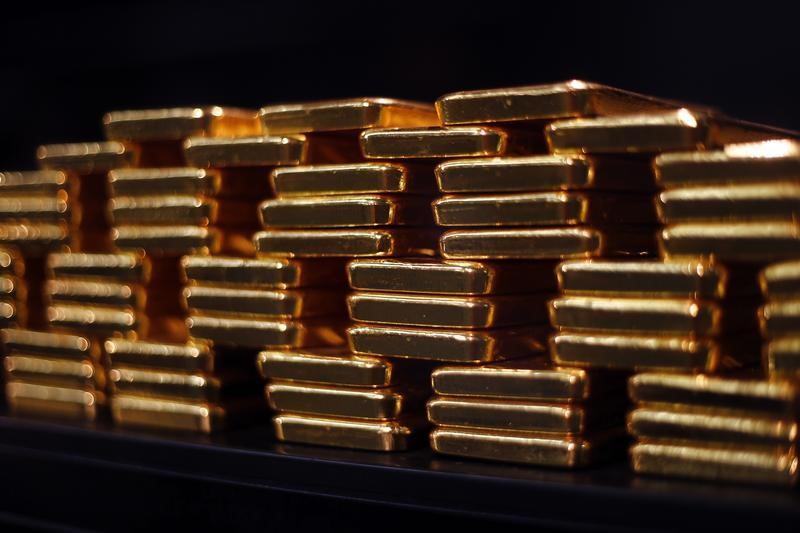

Diversification into inflation hedges is another strategy Green recommends. Assets like gold, Bitcoin , and commodities could serve as essential tools for portfolio protection, and dividend-paying stocks could provide consistent income streams to combat purchasing power erosion due to inflation.

Lastly, he advises minimizing overexposure to sectors that rely heavily on cheap borrowing, such as tech and growth stocks, which could face challenges if rates remain high. Instead, he suggests prioritizing sectors that typically benefit from inflation and steady economic demand, such as energy, utilities, and healthcare.

Green concludes by emphasizing that strategic investors will use this period to reposition for a new reality where caution, vigilance, and adaptability are key.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Source: Investing.com