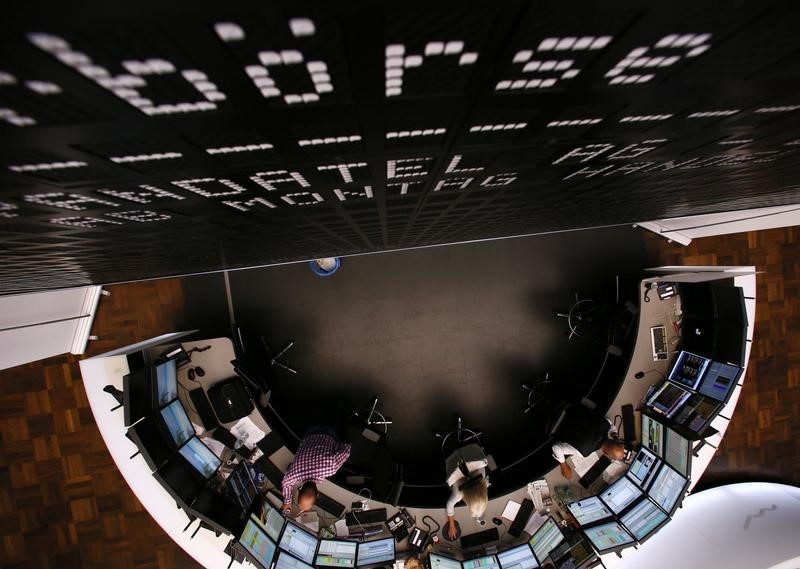

European markets lower amid tariff concerns

Investing.com -- European markets opened on a weaker note Wednesday as investors weighed the potential economic fallout from President-elect Donald Trump's proposed tariff policies.

At 3:21 ET (8:21 GMT), Germany's DAX index was down 0.3%, while France's CAC 40 slipped 0.7% and the UK's FTSE 100 dropped to 0.2%.

Trump’s tariff plans spur inflation fears

Trump announced plans to impose an additional 10% tariff on all Chinese goods entering the U.S. and hinted at a 25% tariff on products from Mexico and Canada, effectively ending the existing regional free trade agreement.

Economists have flagged potential inflationary pressures arising from these policies, which could prompt the U.S. Federal Reserve to slow the pace of interest rate cuts. EasyJet reports record profits, Just Eat plans LSE exit

EasyJet PLC (LON:EZJ ) announced a strong fiscal year 2024, with profit before tax rising 34% to £610 million, driven by a record summer and a 56% surge in holiday bookings.

Going forward, the airline targets 3% capacity growth and aims to reduce winter losses in FY25 while projecting over £1 billion medium-term PBT.

Meanwhile, Just Eat Takeaway.com revealed plans to delist from the London Stock Exchange (LON:LSEG ) (LSE) on 27 December, citing low trading volumes and high costs, while retaining its primary listing on Euronext (EPA:ENX ) Amsterdam. CDI holders are advised to explore conversion options as the transition approaches. Key events to watch

European Central Bank board member Philip Lane is scheduled to deliver introductory remarks at a conference in Frankfurt, while Riksbank Deputy Governor Per Jansson will address an audience in Stockholm. Crude oil edges higher as U.S. inventories decline

Crude oil prices ticked upward after American Petroleum Institute (API) data revealed a significant drop in U.S. oil inventories. Stocks shrank by nearly 6 million barrels in the week ending November 22, defying analysts’ expectations of a 0.25 million barrel build and reversing the previous week’s 4.75 million barrel increase.

At 3:20 ET Brent crude edged 0.5% higher to $72.70 per barrel, while U.S. crude (WTI) rose 0.6% to $69.19 per barrel.

The surprise decline has boosted optimism around strong U.S. fuel demand, raising expectations of tighter oil supplies in the coming months.

The API figures often align with government inventory data, which is set for release later on Wednesday.

Source: Investing.com