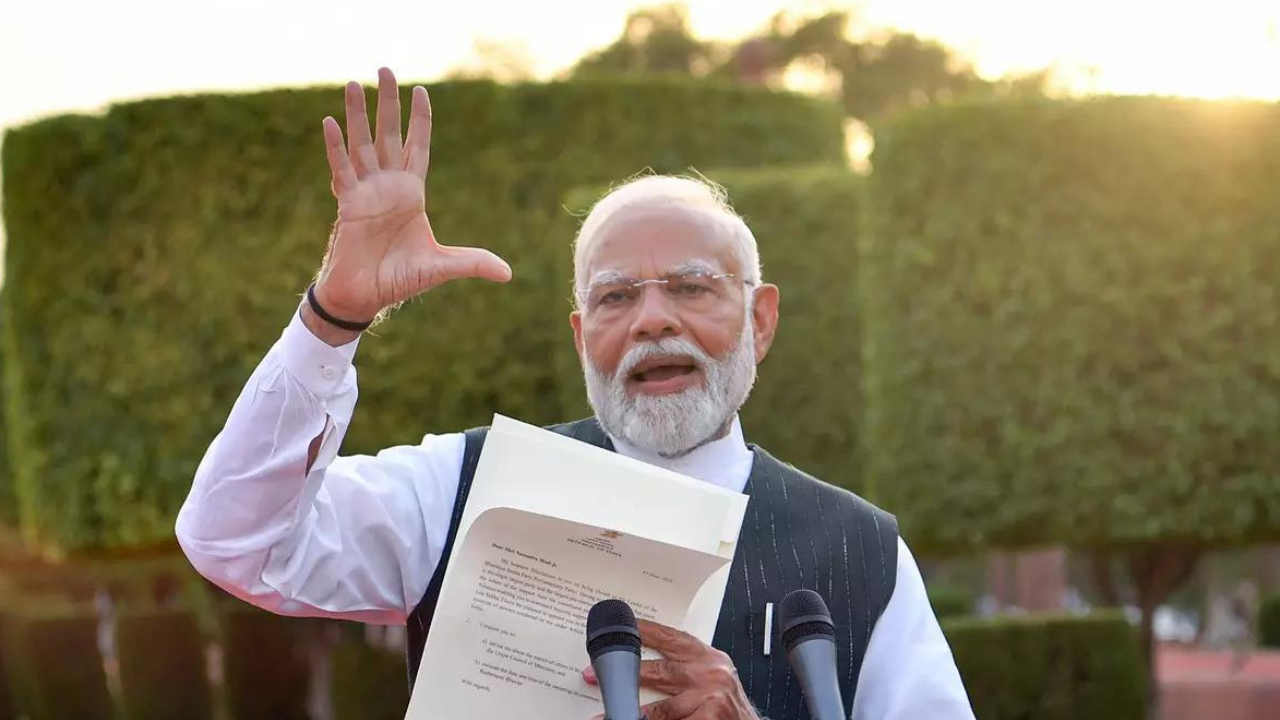

Countdown for first 100 days of Modi 3.0 begins. What should stock investors do?

Countdown for the first 100 days of Modi 3.0 has stock market investors debating over the continuation of winners from Modi 2.0, with Sensex performance in focus.

By kicking off his third term with Kisan Nidhi scheme and Pradhan Mantri Awas Yojana (PMAY), Prime Minister Narendra Modi has left stock market investors debating over whether the much sought-after winners of Modi 2.0 will continue to dominate Dalal Street. All Union Ministries have been asked to finalise their 100-day plans.The first 100 days of the new government will be watched closely by market participants. In 2014 when Modi had won for the first time, had rallied 9.8% in the first 100 days while 2019 saw a decline of 6.74% during the period.

"With cabinet portfolio allocation and being key triggers in the short term, we believe that the first 100 days of government would be crucial for many sectors as it may see new or reiteration of the existing policy framework. As in the past, our sense is that economy-facing sectors such as infrastructure, manufacturing, capital goods and power (especially renewable energy) would benefit from increased capital allocation from the government," Manish Chowdhury, Head of Research, StoxBox, told ETMarkets.

Though investors expect some form of pro-welfare measures due to the coalition government, policy continuity in terms of economic agenda and fiscal prudence is seen as continuing in the third term.

"Our sense is that the outlook for PSUs including railways, defence, power and infrastructure has not changed, although investors should focus on revenue visibility, execution capabilities and timeline and valuation metrics in making their investment decision," he said.

Also read |

While allocating Cabinet ministry portfolios, PM Modi has chosen continuity with Nirmala Sitharaman retaining control of the finance ministry, Rajnath Singh defence and Ashwini Vaishnaw railways.

"It is expected that the NDA government will continue to prioritize industries like banking, infrastructure, and green energy which they did in the first and second term. All the policies that were made and implemented in the last two terms are also likely to continue in the future," says Diwakar Rana, Fund Manager - PMS at Prudent Equity.

Analysts say the government's broad agenda of infra, manufacturing and technology to take the economy forward is unlikely to take a backseat but contentious structural reforms might be delayed.

"We foresee continuity of focus on growth in manufacturing and infrastructure creation in Modi 3.0. Focus on Defense should continue. We are witnessing a good economic momentum and discretionary consumption should do well. We believe that rural consumption should attract investor attention as some budgets would be diversified to populist measures," said Divam Sharma, Founder and Fund Manager at Green Portfolio.

However, some of the sectors related to railways, green energy and PSUs which have run up significantly in anticipation of high growth may normalise in Modi 3.0.

"Post election results investors are clearly circumspect about the PSU space spanning sectors such as Railways, Defence, Power and Infrastructure which can be judged from the fact that all the key sectors and leading companies in these sectors have started underperforming since the election outcome," points out Ruchir Kapoor, Managing Director, Merisis Wealth.

He is of the opinion that money will incrementally rotate into neutral sectors such as IT, consumption, healthcare, autos, chemicals and telecom.

Merisis Multicap PMS has taken a balanced portfolio approach with a mix of high-beta stocks spanning metals, infrastructure, industrials and financials balanced by names that have historically enjoyed low volatility in areas such as telecom, pharmaceuticals, autos and IT, complemented with high exposure to precious metals theme.

Also read |

(Data: Ritesh Presswala)

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Source: Stocks-Markets-Economic Times