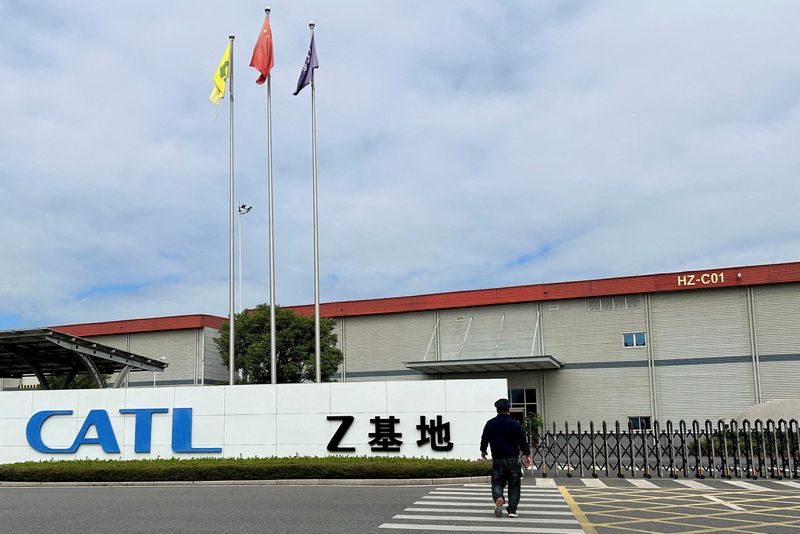

China's battery giant CATL hires banks for first-half Hong Kong float, sources say

By Kane Wu and Selena Li

HONG KONG (Reuters) - Chinese battery giant CATL has hired banks, including JPMorgan and Bank of America, to work on a Hong Kong listing, in what could be one of the city's largest offerings in 2025, two people with knowledge of the deal said.

China International Capital Corp (CICC) and China Securities Co. (CSC) have also been appointed to work on the float, the sources said, declining to be named as the information is confidential.

The offering size for CATL's potential Hong Kong listing hasn't been finalised, sources said, adding it will likely be in the billions of dollars given the Shenzhen-listed company's market cap.

CATL, with a market cap of $150 billion at Monday's close, didn't immediately respond to Reuters comment. Bank of America and JPMorgan declined to comment. CICC and CSC didn't immediately respond to Reuters comment.

The company is targeting the first half for the float, said the two sources.

The planned float in the Chinese offshore market comes amid rising geopolitical tensions as the U.S. last week added Chinese tech companies including CATL and Tencent Holdings (OTC:TCEHY ) to a list of firms it says work with China's military.

CATL's Hong Kong listing plan also comes as the city has seen a surge of new offerings in recent weeks, with increasing interest for a second listing China's from A-share companies, who are seeking to tap into overseas liquidity.

Hong Kong exchange officials in closed-door meetings with banks discussed how to fast-track such second listings, Reuters reported in December citing sources.

Bloomberg on Monday first reported the battery maker is poised to hire the four banks.

CATL was planning to raise at least $5 billion in Swiss global depository receipts (GDR) in 2023, but the plan was eventually scrapped after Beijing regulators raised concerns over the large scale of the offering.

Source: Investing.com