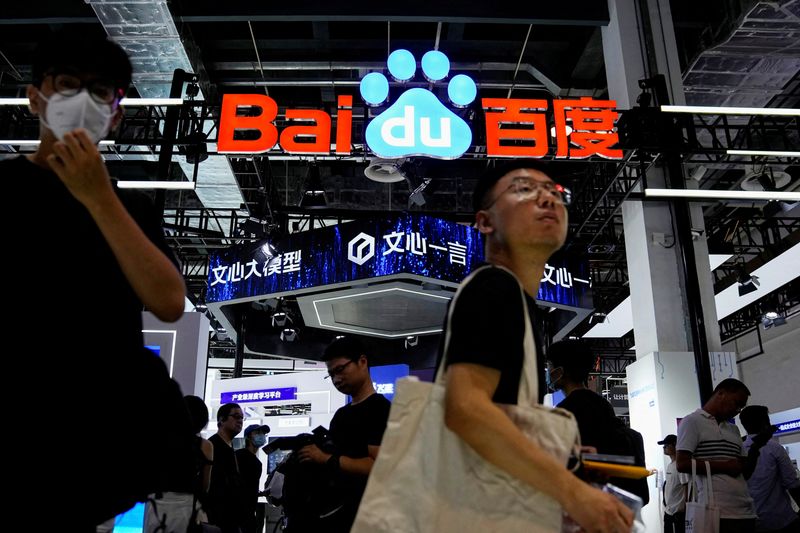

China's Baidu posts 3% fall in third-quarter revenue, meeting market view

(Reuters) -Baidu reported a 3% fall in third-quarter revenue on Thursday, meeting market estimates, as China's biggest internet search provider grappled with weak spending on its advertising services in a sluggish economy.

Baidu (NASDAQ:BIDU )'s U.S.-listed shares rose about 1% in premarket trade.

Baidu, like tech peers, has diversified into autonomous driving as well as artificial intelligence, with its Ernie large-language model powering products such as a ChatGPT-like chatbot.

Still, online advertising tied to its core search business accounts for more than half of its revenue.

Advertisers on its platforms include a large number of small and mid-sized enterprises making Baidu highly sensitive to tepid economic growth and weak consumption, which pressures businesses to curb advertising spend.

Revenue in Baidu's online marketing division fell 4% to 18.8 billion yuan in the quarter versus analysts' 18.89 billion yuan estimate.

Revenue reached 33.56 billion yuan ($4.64 billion) for the three months ended Sept. 30. That compared with the 33.43 billion yuan average of 20 analysts' estimates compiled by LSEG.

Net income climbed 14% to 7.63 billion yuan versus a consensus estimate of 4.67 billion yuan.

Baidu has been able to offset some weakness in advertising revenue thanks to momentum in its non-online marketing business, largely boosted by its AI Cloud segment.

Last week, Baidu unveiled new AI products including smart glasses and a no-code software development tool.

Baidu has also launched a paid version of its chatbot for public use, while offering Ernie's AI capabilities to developers through its cloud computing platform.

It has reported its Ernie platform now handles 1.5 billion daily user queries and interactions versus 200 million in May.

But its mobile chatbot Wenxiaoyan, previously known as Ernie bot, has been overshadowed by ByteDance's Doubao. Wenxiaoyan recorded 3.8 million monthly active users in October 2023, data from consultancy SensorTower showed. Doubao registered 19.4 million.

($1 = 7.2370 Chinese yuan renminbi)

Source: Investing.com