Asian stocks ease as Nvidia's forecast dampens risk appetite

By Ankur Banerjee

SINGAPORE (Reuters) - Asian equities fell on Thursday after AI darling Nvidia (NASDAQ:NVDA ) disappointed investors with a subdued revenue forecast, while the dollar firmed and bitcoin hit a record high in anticipation of U.S. President-elect Donald Trump's proposed policies.

Prevailing geopolitical concerns following the escalating conflict in Ukraine earlier this week led safe-haven assets higher, including gold and government bonds.

The spotlight though was on earnings from the world's most valuable firm Nvidia, which projected its slowest revenue growth in seven quarters, sending its shares lower. Nasdaq futures slipped 0.47%, while S&P 500 futures eased 0.3%.

MSCI's broadest index of Asia-Pacific shares outside Japan eased 0.23%, with tech heavy Taiwan stocks down 0.5%. Japan's Nikkei fell 0.7%.

George Boubouras, head of research at Melbourne-based K2 Asset Management, said the market reaction to Nvidia's earnings was partly a result of very high expectations for each quarterly result. "While they delivered impressive revenue growth and momentum, the market clearly wants more."

Charu Chanana, chief investment strategist at Saxo, said Nvidia earnings were a clear indication that the momentum in AI was only extending, with supplies being the bigger headwind rather than demand.

"The structural AI tailwind could continue to be a key driver for equities into the next year."

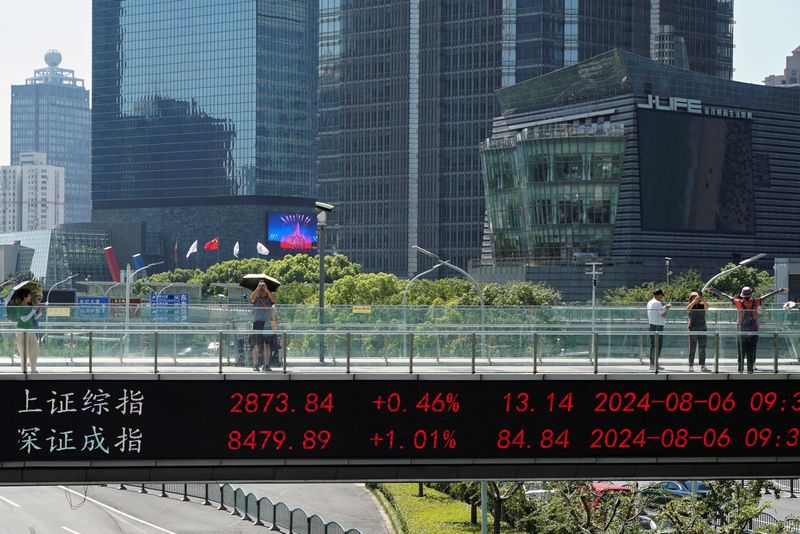

Elsewhere in Asia, stocks in China opened a shade lower, while Hong Kong's Hang Seng fell 0.22% at the open as the market remains rangebound even as some global funds follow domestic money into market segments sheltered from tariffs.

Investor focus will also be on Indian conglomerate Adani Group after U.S. prosecutors said on Wednesday that Gautam Adani, billionaire chair of the group, has been indicted in New York over his role in an alleged multibillion-dollar bribery and fraud scheme.

Dollar bond prices for Adani companies fell sharply in early Asia trade on Thursday.

SOARING DOLLAR

The dollar has been on the rise since the U.S. election in early November on anticipation that proposed tariffs of the incoming Trump administration will likely be inflationary and keep rates higher for longer.

The dollar index , which measures the U.S. currency against six rivals, was at 106.56, not far from the one-year high of 107.07 it touched last week. The index has risen more than 2% since the Nov. 5 election. [FRX/]

The prospect of the Federal Reserve having to temper its rate cut cycle has also boosted the dollar. Markets were pricing in the Fed lowering borrowing costs by 25 basis points next month at 56%, down from 82.5% just a week ago, according to CME's FedWatch Tool.

Two Federal Reserve governors on Wednesday laid out competing visions of where U.S. monetary policy may be heading, with one citing ongoing concerns about inflation and another expressing confidence that price pressures will continue to ease.

The rise in the dollar has led the Japanese yen back into intervention territory, leading to verbal warnings from officials. On Thursday, the Asian currency strengthened a bit and was last at 155.04 per dollar.

Bitcoin has been on a tear since the election as the Trump administration are expected to relax regulations and be crypto friendly.

The world's largest cryptocurrency, bitcoin, soared to touch a record of $95,040 in early trading and was last at $94,787.

In commodities, supply concerns triggered by escalating geopolitical tensions amid the ongoing war between Russia and Ukraine led oil prices higher.

Brent crude futures for January rose 0.5% to $73.17, while U.S. West Texas Intermediate crude futures for January gained 0.5%, at $69.11.

Gold prices were on the rise for fourth straight session on safe asset demands. Spot gold rose 0.15% at $2.654 per ounce. [GOL/]

Source: Investing.com