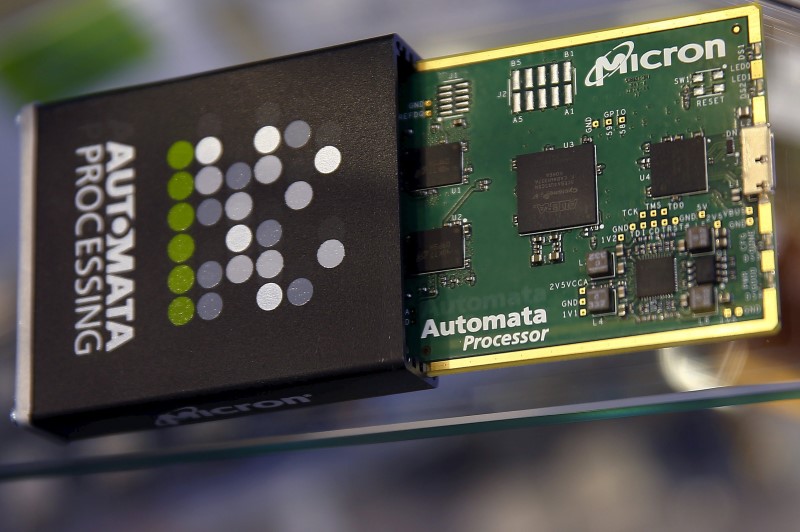

Asian chipmaking stocks slide on weak Micron outlook, Fed jitters

Asian chipmaking stocks tumbled on Thursday, tracking steep overnight declines in their U.S. peers after memory chip giant Micron presented softer-than-expected guidance for the current quarter.

Tech stocks were also battered by a wider sell-off after the U.S. Federal Reserve signaled a substantially slower pace of rate cuts in 2025.

South Korea’s SK Hynix Inc (KS:000660 ) was by far the worst performer among Asian chip stocks, losing about 5%, while peer Samsung Electronics Co Ltd (KS:005930 ) shed 2.9%.

Both stocks- which are major players in the memory chip industry- tracked a 16% slump in Micron Technology Inc (NASDAQ:MU ), after the U.S. firm’s revenue guidance for the current quarter missed expectations.

Micron guided current quarter revenue of $7.90 billion, plus or minus $200 million. The figure missed street estimates of $8.98 billion. EPS was guided at $1.43, missing estimates of $1.91.

The chipmaker’s quarterly earnings mostly met estimates. But the big miss on its guidance fueled concerns over just how resilient artificial intelligence-fueled demand for chips remained going into 2025, after a major spike in sales over the past year.

High-bandwith memory chips are a key component of advanced AI chips. Micron and SK Hynix saw a sharp increase in sales over the past year on this trend.

Analysts at Mizuho (NYSE:MFG ) cut Micron’s price target on the guidance miss, but maintained the stock at Outperform, stating that weakness in its traditional memory offerings was likely to be offset by increased demand for HBM chips in the coming year. Asian chipmaking stocks fall

Losses in Micron and its peers spilled over into broader chipmaking stocks.

Japan’s Advantest Corp. (TYO:6857 ) and Tokyo Electron Ltd. (TYO:8035 ) fell 1.7% and 1.2%, respectively, while Taiwan’s TSMC (TW:2330 ) (NYSE:TSM ) fell 1.8% in Taipei trade.

Technology conglomerate tumbled 4%, given that it is heavily invested in tech and chipmaking stocks.

In China, Semiconductor Manufacturing International Corp (HK:0981 )- the country’s biggest chipmaker- fell 0.2%, while Advanced Micro Fabrication Inc (SS:688012 ) fell 1.4%.

Source: Investing.com