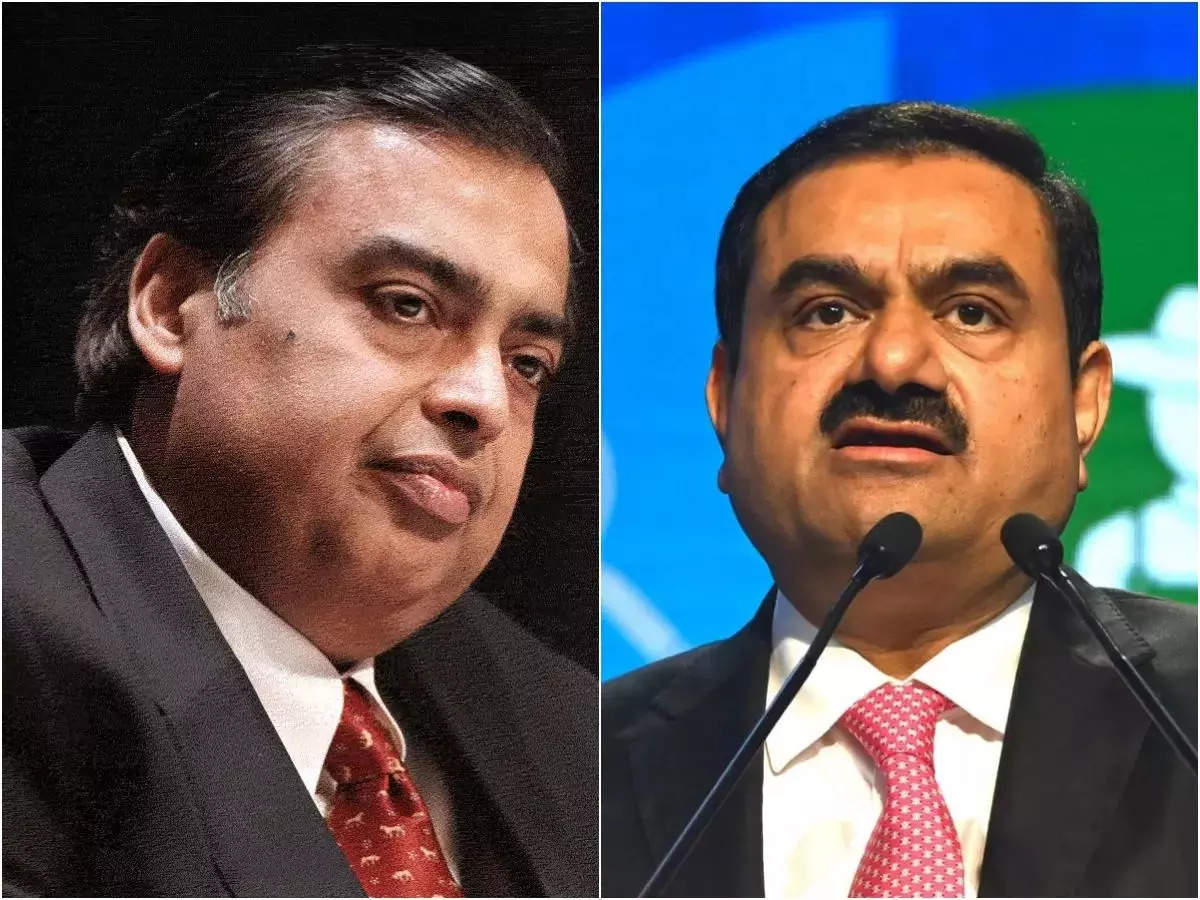

Ambani, Adani collaborate for first time: Reliance picks 26% stake in Adani Power project

In the first collaboration between rival billionaires, Mukesh Ambani's Reliance Industries has picked up a 26 per cent stake in a Madhya Pradesh power project of Gautam Adani, and signed a pact to use the plants' 500 MW of electricity for captive use.

In the first collaboration between rival billionaires, 's has picked up a 26 per cent stake in a Madhya Pradesh power project of , and signed a pact to use the plants' 500 MW of electricity for captive use. will pick up 5 crore equity shares in Mahan Energen Ltd, a wholly owned subsidiary of , of face value Rs 10 at par (Rs 50 crore) and will use 500 MW of generation capacity for captive use, the two firms said in separate stock exchange filings.The two businessmen hailing from Gujarat have often been pitted by media and commentators against each other but they have for years tiptoed around each other to reach the top two rungs of Asia's wealth ladder.

With Ambani's interests spanning oil and gas to retail and telecom and Adani's focus on infrastructure spanning sea ports to airports, coal and mining, they rarely crossed each other's path except in the clean energy business where the two have announced multi-billion investments.

Adani aspires to be the world's largest renewable energy producer by 2030 while Reliance is building four gigafactories at Jamnagar in Gujarat -- one each for solar panels, batteries, green hydrogen, and fuel cells.

Adani is also building three giga factories for manufacturing solar modules, wind turbines and hydrogen electrolysers.

A clash was also forecast when Adani group applied to participate in an auction of spectrum or airwaves capable of carrying fifth generation (5G) data and voice services. However, unlike Ambani, Adani bought 400 MHz spectrum in the 26 GHz band, which is not for public networks.

On the contrary, the two have been far from rivals. In 2022, a firm with erstwhile links to Ambani sold its stake in news broadcaster NDTV to Adani, paving the way for the takeover.

Adani was also present at pre-wedding celebrations of Ambani's youngest son, Anant, at Jamnagar earlier this month.

"Mahan Energen Ltd (MEL), wholly owned subsidiary of Ltd (APL), has entered into a 20-year long-term power purchase agreement (PPA) for 500 MW with Reliance Industries Ltd (), under the captive user policy as defined under the Electricity Rules, 2005," Adani Power said in the filing.

One unit of 600 MW capacity of MEL's Mahan thermal power plant, out of its aggregate operating and upcoming capacity of 2,800 MW, will be designated as the captive unit for this purpose.

A generating plant declared as a captive generating plant (CGP) is required to abide by the rules that state that the captive user(s) consuming the power generated from the captive generating plant for self-use must necessarily hold not less than 26 per cent of the ownership in the captive generating company.

"In order to avail the benefit of this policy, RIL has to hold a 26 per cent ownership stake in the captive unit in proportion to the total capacity of the power plant. It will accordingly invest in 5 crore equity shares of MEL, aggregating to Rs 50 crore for the proportionate ownership stake," the filing said.

"This development brings between two corporates an exclusive arrangement for 500 MW of power purchase by Reliance Industries on a long-term basis."

It is unclear where Reliance intends to use the MEL power. It already has captive units at mega oil refining and petrochemical complexes in Gujarat and Maharashtra and its coal-bed methane (CBM) extractions in Sohagpur in Madhya Pradesh may not need 500 MW of electricity.

"In this connection, APL, MEL, and RIL have signed an investment agreement on 27th March 2024 at 7:00 pm. Closing of the transaction is subject to customary closing conditions including receipt of requisite approvals," Adani Power said.

Reliance in the filing made a similar disclosure, adding, "MEL, a company engaged in generation and supply of power, was incorporated on October 19, 2005. The turnover of MEL, as per its audited standalone financial statement, for financial years 2022-23, 2021-22 and 2020-21 was Rs 2,730.68 crore, Rs 1,393.59 crore and Rs 692.03 crore, respectively."

"The investment is subject to customary conditions precedent including receipt of requisite approvals by MEL and is expected to be completed within 2 weeks of receipt of completion of conditions precedent and receipt of such approvals by MEL," it added.

Source: Stocks-Markets-Economic Times