Accenture's revenue outlook cut sends IT stocks crashing

Investors reduced IT shares post Accenture's lowered revenue guidance, impacting Nifty IT, TCS, Infosys, Cyient, Mastek, LatentView, LTI Mindtree, Wipro, HCL Technologies. Cautious sentiment lingers with modest prospects till 2024.

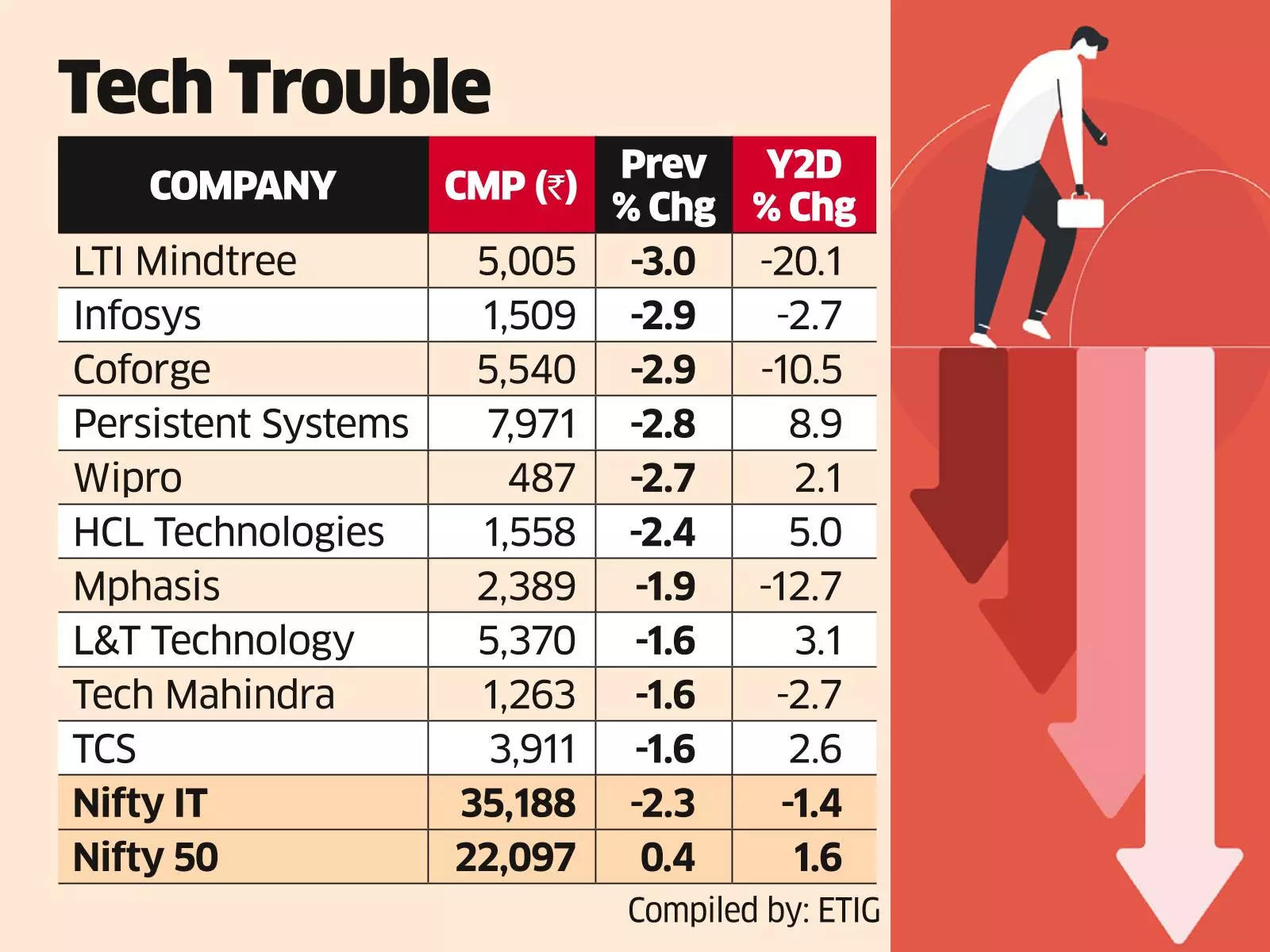

Mumbai: Investors cut exposure to information technology (IT) shares on Friday as 's reduction in revenue growth guidance dented hopes of demand recovery. Analysts said the cautious sentiment in may persist for a while with their business prospects expected to remain modest at least in 2024. , , , , and LatentView are among some of analysts' top picks.Nifty IT declined 2.33% on Friday while the benchmark Nifty gained nearly 0.4%.

"The lowering revenue guidance implies that a recovery in IT companies is only likely at the end of FY25," said Pankaj Pandey, head of research, ICICI Securities. "The next few quarters are expected to be muted for IT companies which triggered the negative reaction."

LTI Mindtree fell 2.9% on Friday while Infosys and Wipro declined 2.8% and 2.5%, respectively. Tata Consultancy Services dropped 1.6% and HCL Technologies fell 2.4%.

Analysts said other large cap IT companies too may report cuts in revenue guidance in the March quarter. Mid-tier IT companies are expected to witness sharper cuts.

"The slump in IT stocks is because market leader like Accenture has cut back its revenue estimates sharply which indicates that the hope of improving discretionary spend is fading away," said Sumit Pokharna, VP and IT analyst, Kotak Securities.

Pokharna said since Accenture has reduced revenue estimates, other IT companies engaged in short-cycle discretionary projects like Wipro, Infosys, and Mphasis are adversely impacted.

Analysts said that the total contract value may see a slowdown in the next few quarters for some companies and keeping it elevated is the key challenge for the sector.

Some companies may report earnings surprises in the near term.

"Near-term outlook is of acceleration as companies are sitting on order backlog and may see some benefits in terms of interest rates and faster execution," said Mohit Jain, research analyst, Anand Rathi Institutional Equities. "However, there is no respite in Q4 or Q1FY25, as judged by Accenture."

Jain said that Mastek and LatentView are his stock picks in the sector.

Analysts said that the valuations in the IT sector are largely in line with the historical averages.

"Over the numbers reported in the March quarter, the management commentary would be keenly watched," said Pandey. "If the commentary is better than anticipated, then a price action move is likely."

While the near-term outlook for the sector remains hazy, an earlier-than-expected interest cut by the US Fed could support IT stocks.

"Given the guidance, the outlook for the IT sector in the near term remains bleak," said Pokharna. "However, the demand environment could improve if there is an interest rate cut by the US Fed earlier than anticipated."

Pokharna said that TCS, Infosys, and Cyient are his top stock picks in the IT sector.

Source: Stocks-Markets-Economic Times