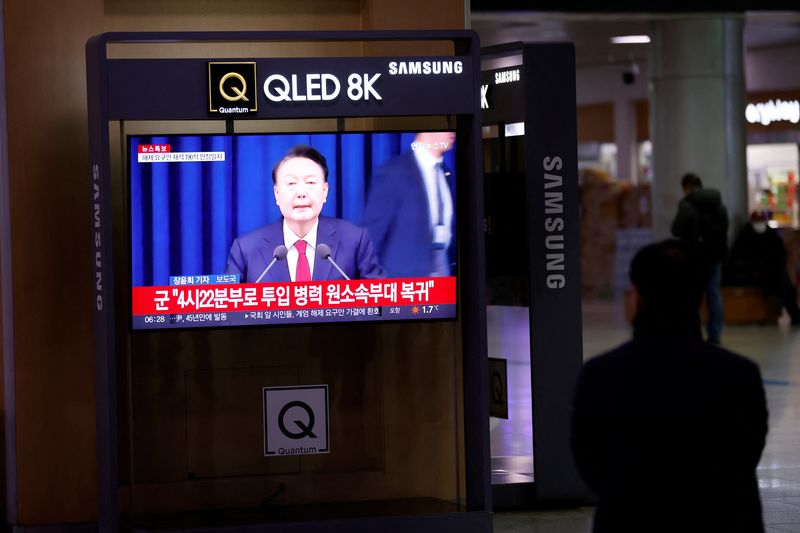

South Korea stocks slide as President Yoon's failed martial law bid stokes turmoil

SEOUL (Reuters) - Round-up of South Korean financial markets:

** South Korean shares declined on Wednesday after the nation's president declared martial law and then rescinded it hours later in the biggest political crisis in decades in Asia's fourth-largest economy.

** The won partially recovered after a sharp drop earlier, while the benchmark bond yield rose.

** The KOSPI closed down 36.10 points, or 1.44%, at 2,464.00.

** Among index heavyweights, chipmaker Samsung Electronics (KS:005930 ) fell 0.93%, while peer SK Hynix gained 1.88%. Battery maker LG Energy Solution slid 2.02%.

** South Korea's President Yoon Suk Yeol on Wednesday said he would lift the surprise martial law declaration he had imposed just hours before, backing down in a standoff with parliament which roundly rejected his attempt to ban political activity and censor the media.

** The finance ministry said it was ready to deploy "unlimited" liquidity into financial markets in the wake of the political crisis that sent the won diving to multi-year lows.

** Hyundai (OTC:HYMTF ) slipped 2.56%, while sister automaker Kia gained 0.10%. Search engine Naver lost 3.11%, while instant messenger Kakao jumped 8.50%.

** Of the total 938 traded issues, 176 advanced and 737 declined.

** Foreigners net sold shares worth 408.8 billion won ($290 million) on the main board.

** The KOSPI has fallen 7.20% so far this year, losing 2.7% in the previous 30 trading sessions.

** The won has lost 8.7% against the U.S. dollar so far this year.

** In money and debt markets, December futures on three-year treasury bonds fell 0.08 point to 106.79.

** The most liquid three-year Korean treasury bond yield rose 3.2 basis points to 2.621%, while the benchmark 10-year yield added 5.3 basis points to 2.759%.

($1 = 1,409.5900 won)

Source: Investing.com