Price of China's strategic germanium hits record high on possible state buying

BEIJING/SINGAPORE (Reuters) - Prices of germanium, a strategic metal key to chipmaking, hit a record high on Wednesday in top producer China, driven by speculation of possible state buying, industry sources said.

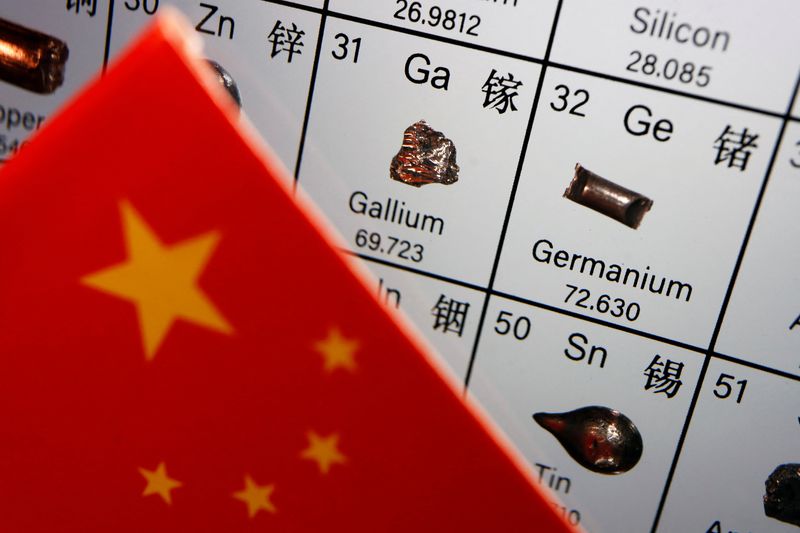

China supplies 60% of the world's germanium, which is used in applications such as fibre optic cables, solar cells and infrared technology. It imposed controls over exports of germanium and gallium products last August.

Spot prices of germanium ingot have jumped nearly a third in the past month to an all-time high of 13,250 yuan ($1,826.48) a kilogram (kg) on Wednesday, data from information provider Shanghai Metals Market (SMM) showed.

Prices have climbed 38% since export restrictions took effect, defying expectations that more supply left in the domestic market would keep local prices under pressure.

Several industry insiders, who declined to be named as the information was confidential, said the rally was underpinned by speculation The National Food and Strategic Reserves Administration, China's state stockpiling agency, was buying around 100 metric tons.

It was unclear how much the state stockpiler may have paid, the sources said.

China's stockpiling agency did not immediately respond to a request for comment.

"The market chatter lifted sentiment, contributing to this price surge, but we prefer to take a watchful stance as it's a bit too speculative, therefore a downward correction may come even more rapidly," said a Chinese germanium trader.

Recent demand from both overseas and domestic users is also supporting prices, a Chinese germanium exporter said.

"We have recently received a lot of inquiries from Japan and South Korea for germanium oxide," said the person, declining to be named.

China's exports of germanium, including wrought and unwrought products, tumbled in the first five months of this year 55% from the same year-ago period to 11.08 tons, even as the value of shipments surged nearly 300%, customs data showed.

($1 = 7.2544 Chinese yuan )

Source: Investing.com