Oil prices climb on Fed rate cut outlook

By Emily Chow and Trixie Yap

SINGAPORE (Reuters) -Oil prices rose in Asian trade on Monday amid expectations of a U.S. interest rate cut this week, though gains were capped by persistent demand worries and weaker China data.

Brent crude futures for November were up 38 cents, or 0.5%, at $71.99 a barrel at 0700 GMT. U.S. crude futures for October were up 49 cents, or 0.7%, at $69.14 a barrel.

Both contracts had settled lower in the previous session, with concerns about supply disruptions easing as Gulf of Mexico crude production resumed following Hurricane Francine and as rising data showed a weekly rise in U.S. rig count.

Still, nearly a fifth of crude oil production and 28% of natural gas output in the Gulf of Mexico remain offline in the hurricane's aftermath.

"Markets are focused on upcoming FOMC policy decisions and traders are likely to stay cautious," said Phillip Nova senior market analyst Priyanka Sachdeva, adding that prices are still supported by some supply worries given some capacity remains offline in the Gulf of Mexico.

The Federal Open Market Committee (FOMC) is expected to make a decision during its Sept. 17-18 meeting.

Fed fund futures show investors are increasingly betting the U.S. central bank will cut by 50 basis points (bps) instead of 25 bps, according to CME FedWatch.

Lower interest rates typically reduce the cost of borrowing, which can boost economic activity and lift demand for oil.

However, analysts are concerned that an aggressive rate cut of 50 bps could signal underlying recession worries, which would be a bane for demand.

"A cut of 50 bps from the Fed will likely indicate weakness in the U.S. economy, raising demand concerns for oil," said OANDA senior market analyst Kelvin Wong in an email.

Optimism in the market was dampened by weaker Chinese economic data released over the weekend, with the low-for-longer growth outlook in the world's second largest economy reinforcing doubts over oil demand, said IG market strategist Yeap Jun Rong in an email.

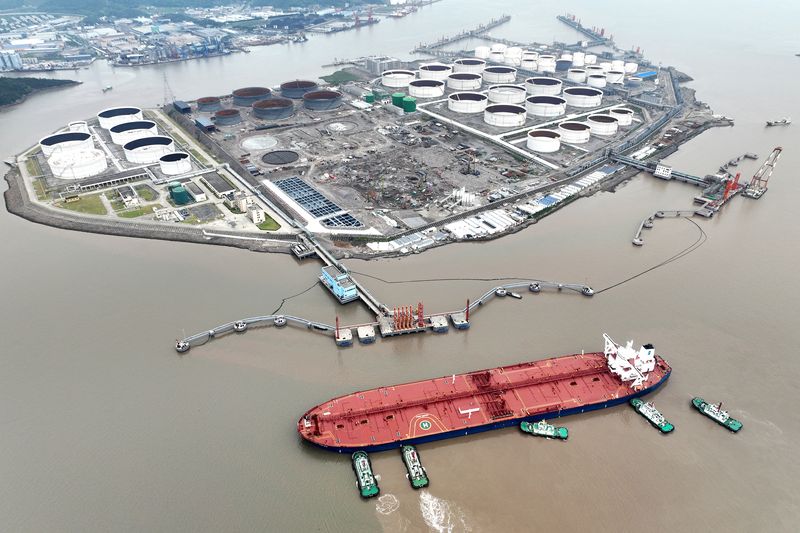

Industrial output growth in China, the world's top oil importer, slowed to a five-month low in August, while retail sales and new home prices weakened further.

"Coupled with increased odds of a deflationary risk spiral in China after industrial production and retail sales growth declined in August, the current rebound in WTI crude oil is likely unsustainable with intermediate key resistance at US$72.20/73.15 per barrel," OANDA's Wong said.

Oil refinery output also fell for a fifth month as disappointing fuel demand and weak export margins curbed production.

Source: Investing.com