No rate cut seen in August either, but enough signs of a shift in stance

The minutes of the meeting will be available on June 21. Varma and Goyal have argued that high interest rates might be hindering potential growth. They have previously debated that a high real interest rate—the difference between the actual interest rate and inflation—could be compromising growth.

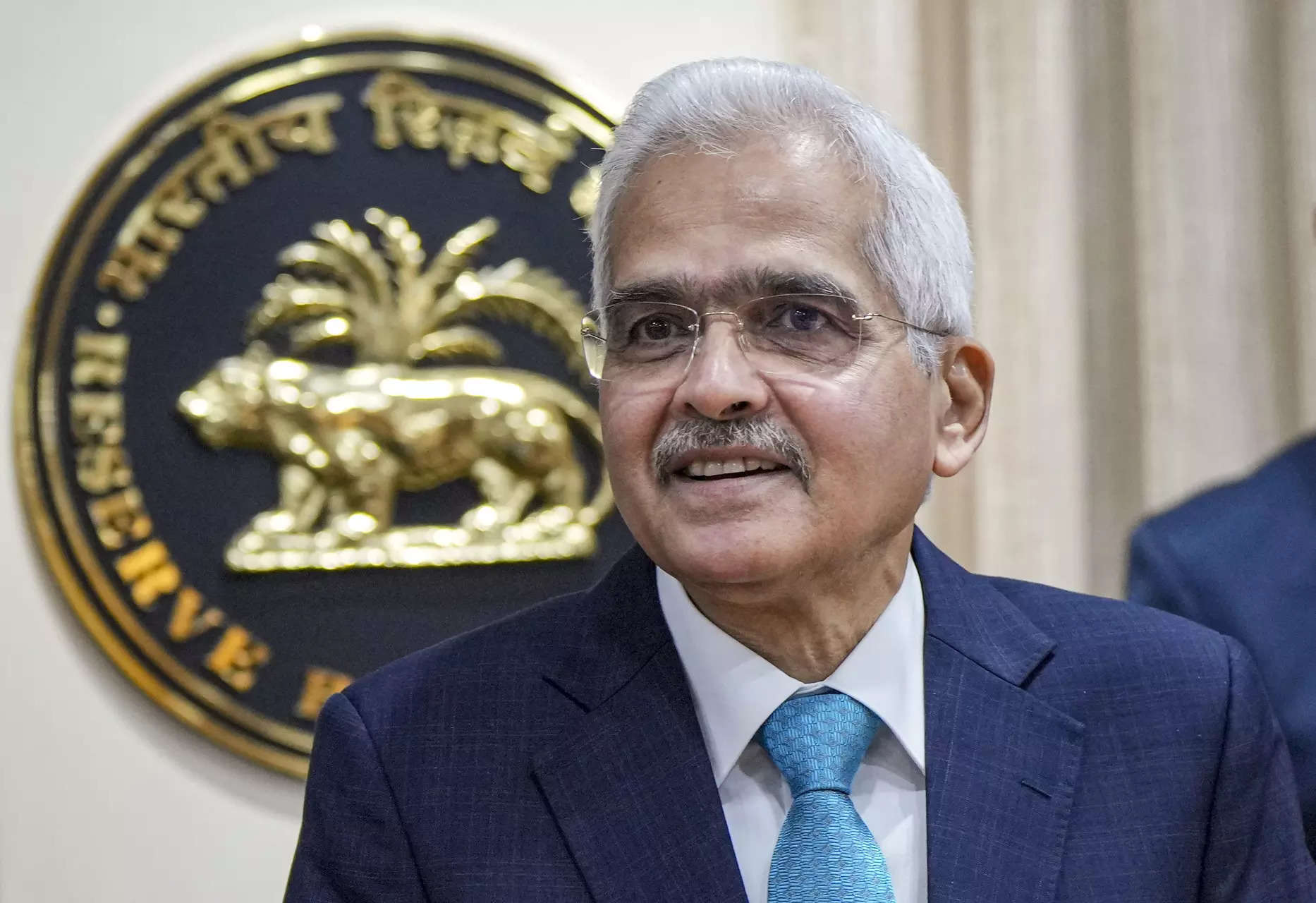

Mumbai: The dissenters' queue in the () for having the policy rates lowered may be growing, but that's hardly any indication that the cost of borrowing is coming down anytime soon.Ashima Goyal, an external member, joined JR Varma to vote against the status quo of keeping the , the rate at which the lends to banks, and instead were seeking to lower rates by 25 basis points. A basis point is 0.01 percentage point. The two also sought a change in monetary stance from withdrawal of accommodation.

While the minutes of the meeting would be available on June 21, the arguments of Varma and Goyal have been that the high may be shaving off potential . In the past, they have debated that a high real interest rate, the differential between the actual interest rate and , is probably leading to a compromise in growth.

"In terms of current and expected core inflation, real interest rates are now higher than the natural or neutral interest rate compatible with keeping inflation at target and output at potential," wrote Ashima Goyal in the minutes of the last meeting.

In the normal course of events, the rising dissent in the MPC should have led to more joining the camp of seekers as data turns benign. Inflation may not have come back to the 4% target, but it's not threatening to soar. For the US, it is at 3.4% in April when the target is 2%.

Four factors are at play - the spending plans of the new government, monsoon that would determine food prices, a 7.2% economic growth, and the composition of the next MPC as the current one's life ends after the next meeting.

"Strong growth conditions have provided the policy space to remain on pause until there is further clarity on food inflation risks," said Gaura Sen Gupta, economist, . "More clarity will be available by mid-July when the final will be presented. We expect the focus to remain on and continued capex push."

A clearer picture of most of these would emerge by August when the MPC reconvenes. The union budget would be behind, the monsoon would be halfway providing better grounds to assess future inflation. Furthermore, the could release its assessment of the that would make forecasts a bit easier.

"If it's a gentle rise from, say, 1% as per RBI's previous assessment to 1.5%, there could be space for 25-50 basis points easing, but if it is a doubling of neutral rates, then there may not be much room for rate cuts,'' said Pranjul Bhandari, economist at .

One decisive change after the election results that diminished the Parliamentary majority for the BJP is the outlook on government spending. The popular theory is that the administration could turn populist, but it can be the other way too since the Modi government has been determined to get a credit rating upgrade.

The unknown is: What are the demands on the government's funds? No doubt it is on a stronger footing, thanks to the RBI's generous ₹2.1 lakh crore dividend. But what if alliance partner Chandrababu Naidu, starved off funds to build a new capital for his young state, sets his eyes on it?

Globally, central banks such as the European Central Bank and Bank of Canada have started the easing cycle. The RBI maintains that its actions depend on domestic conditions.

Although one may not expect an interest rate cut in the next meeting in August, there may be enough evidence to at least shift the stance to neutral that would provide room to act either way before Das' term comes up for renewal.

Source: Stocks-Markets-Economic Times