Lok Sabha election begins: How Nifty may behave before results and which stocks to buy?

Investors monitor Sensex behavior during Lok Sabha election. FPIs sell Indian stocks. Hope for a good monsoon. Structural growth opportunity in Indian equities. Tata Steel, JSW Steel, Tata Motors, and HAL among recommended stocks.

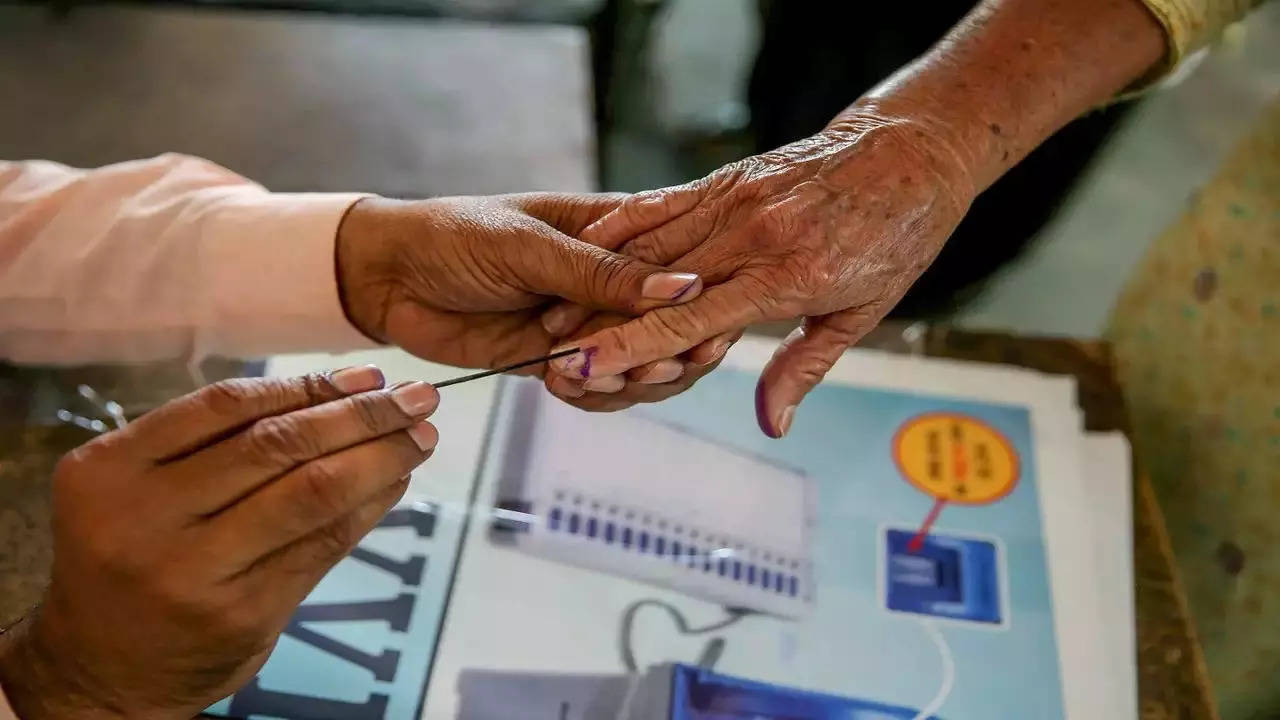

As polling for the seven-phase-long Lok Sabha election began from today, Dalal Street's 9 crore investors would be closely tracking the mood of 96.8 crore voters spread across India. Ahead of the voting for the first phase, has given up almost all of its gains made in 2024 after rewarding investors with a 20% upside last year.Typically, the market starts pricing in the impact of the election several months before but remains flattish during the elections. Dalal Street's pre-election rally started on December 4th 2023 when the Sensex rallied by 1384 points in response to the state election results which saw BJP retaining power in Madhya Pradesh and wrestling Rajasthan and Chhattisgarh from the opposition.

"Sensex and will likely remain range-bound till the time the first 3-4 phases of voting is over in the next one month. After that, smart money will start building positions in anticipation of the outcome of the election. Investors won't wait till the results are announced to go long or short," Sunny Agrawal, Head of Fundamental Research at SBIC Securities told ETMarkets.

For the next one month, therefore, he expects stock-specific action based on Q3 results and earnings, but any large upside or downside looks limited

"The outcome of the election is already priced in. The dip we have seen in recent days is predominantly due to external factors related to rising crude oil prices and FPI outflows because of rising bond yields and amendment in India-Mauritius tax treaty," Agrawal said, adding that the volatility is purely driven by liquidity issues.

Another positive factor during the election season is the hope of a good monsoon with the Indian Meteorological Department predicting above average rainfall this year.

Also read |

Although seemingly unrelated to the election cycle, the FPI behaviour in the last few days isn't a good sign. In the last 4 trading sessions, foreigners have sold Indian stocks worth nearly Rs 20,000 crore. As a result, Sensex has also fallen 2,500 points during the period.

“We would expect a dip in markets in the months post elections in line with what we have seen most election cycles after 1999. However, we believe inflation is being well managed, and the expected rate cuts, coupled with a likely yet unprecedented third term of this popular government should provide a sustainable boost to markets after that,” Aniruddh Madhusudan of Haitong Securities said.

The analyst draws parallel from the 2019 Lok Sabha election where the BJP remained in power as expected, though with a much stronger showing than predicted.

"Markets remained elevated post the elections, but then quickly dropped to pre-election levels before soaring once again. We would use this particular instance to guide us as the macro scenario retains many of the same characteristics. A proven incumbent, the likelihood of a declining interest rate environment, and the country coming off the drought effects of an El Nino," Madhusudan said.

Which stocks to buy?

Citing the structural growth opportunity in Indian equities, JPMorgan has told clients to make use of any dips during the election cycle. "Long-term investors could be at least ‘neutral’ relative to the benchmark, and a strategic ‘overweight’ is warranted in our view," the brokerage has said.Going by promises made in BJP's election manifesto, brokerages see opportunities in railways, defence, auto, pharma, affordable housing and hotels.

Stocks that have been listed as potential beneficiaries by various brokerages include , , , , , , Titagarh, Texmaco, , M&M, Olectra, , , Motherson, Sona BLW, , Mazagon Dock, L&T, and .

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Source: Stocks-Markets-Economic Times