Hess CEO upbeat on oil demand, says Guyana's potential barely scratched

By Sheila Dang

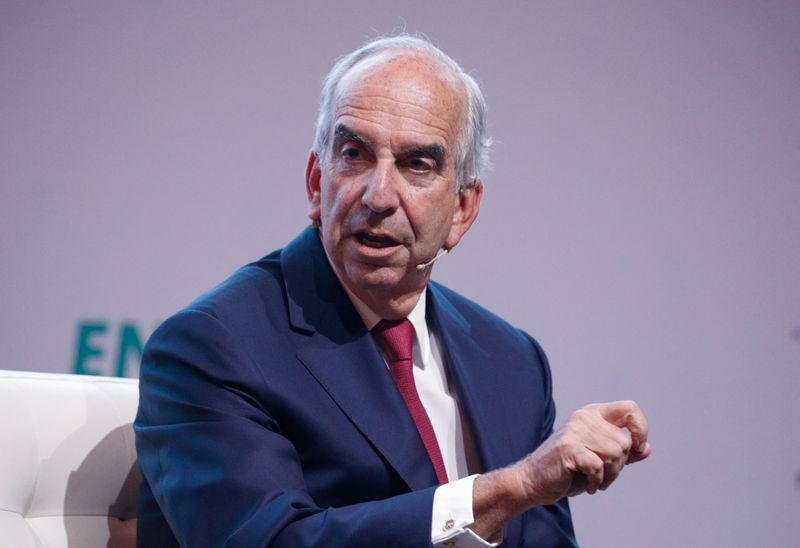

HOUSTON (Reuters) -Hess CEO John Hess (NYSE:HES ) said on Tuesday he sees the oil market as closer to being balanced than oversupplied this year, despite worries about demand from China and greater production from U.S. and non-OPEC producers.

He offered an optimistic view of the shale oil market and his company's own prospects in Guyana in remarks to investors at the Goldman Sachs Energy, CleanTech and Utilities Conference in Miami, but cautioned the market could be volatile this year, citing political risks with Iran and Venezuela.

"Demand is a little more robust than people thought," said Hess, adding that analysts were looking at projected inventory builds of a million barrels per day, which has been cut by half.

Hess said the company has a long way to go in Guyana, with production on the discoveries to date still early. He said the Guyana joint venture with Exxon Mobil (NYSE:XOM ) and CNOOC (NYSE:CEO ) plans to add two more vessels in 2026 and 2027, bringing the total to six.

Those will still only tap five of the 11 billion barrels of oil equivalent that have been discovered so far, Hess said.

Investors can expect more efficiency in shale oil drilling, which will offset the fact that shale, other than the Permian Basin oilfield, is now a mature 20-year-old industry, Hess said.

Hess is producing 200,000 barrels per day in shale, which will "run for the next 10 years at that kind of rate," he said.

Chevron (NYSE:CVX )'s $53 billion deal to acquire Hess has been stalled by a contract arbitration challenge by Exxon Mobil and CNOOC, who claim a right of first refusal to any sale of Hess's Guyana assets.

Hess said on Tuesday that he expects a decision in the arbitration case by late August or September. "We're very confident that the merger is going to go through and we're getting prepared for that," Hess said.

When asked for his message to President-elect Donald Trump, Hess said the incoming president has been a supporter of the industry, while emphasizing that the U.S. must maintain its energy security and independence by refilling U.S. emergency oil stocks.

He urged Trump to eliminate red tape in order to build more data centers underpinned by natural gas to support the advancement of artificial intelligence.

Hess said his company is entering the new year on a solid footing, meeting or beating its guidance on production and beating analyst consensus on its financial performance in 2024.

Source: Investing.com