Foxconn sees robust AI server demand, posts 14% rise in Q3 profit

By Yimou Lee and Faith Hung

TAIPEI (Reuters) -Taiwan's Foxconn (SS:601138 ), the world's largest contract electronics maker, said on Thursday it expected robust growth in its artificial intelligence server business next year after reporting a better-than-expected 14% rise in quarterly profit.

The firm, a key supplier to Apple (NASDAQ:AAPL ) and Nvidia (NASDAQ:NVDA ), kept its 2024 guidance of "significant" sales growth and forecast AI servers would account for 50% of its total server revenue next year.

Foxconn said last month it was building the world's largest manufacturing facility in Mexico for bundling Nvidia's GB200 superchips, a key component of the U.S. firm's next-generation Blackwell family computing platform.

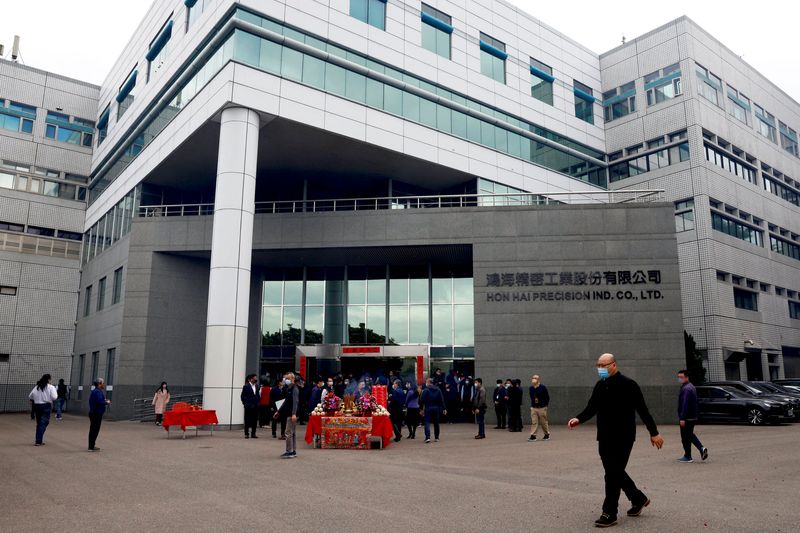

Underscoring Foxconn's rosy prospects, October sales hit a record high for the month and the company, formally called Hon Hai (TW:2317 ) Precision Industry, has said it expects fourth-quarter revenue to grow year-on-year.

It does not provide numerical guidance.

Net profit for July-September for Apple's top iPhone assembler came in at T$49.3 billion ($1.5 billion), according to Reuters calculations.

That marked a fifth consecutive quarter of profit growth and compared with a T$46.3 billion LSEG consensus estimate of 14 analysts.

Last month, the company said third-quarter revenue jumped 20% from a year earlier, beating expectations to post its highest-ever revenue for that quarter on strong sales of AI servers.

Foxconn's shares have doubled so far in 2024, beating the broader market's 28% gain, buoyed by its confident outlook on AI.

They closed down 1.4% on Thursday ahead of the earnings release.

($1 = 32.4140 Taiwan dollars)

Source: Investing.com