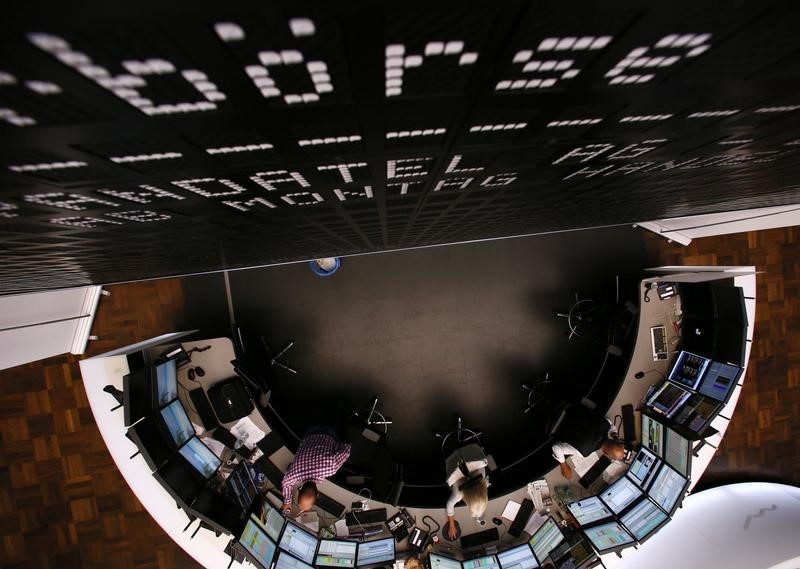

European markets mostly lower; French sentiment weak while EasyJet impresses

Investing.com -- European markets traded mostly lower Wednesday, as investors digested weak regional sentiment data and the potential economic fallout from President-elect Donald Trump's proposed tariff policies.

At 07:00 ET (12:00 GMT), Germany's DAX index was down 0.4%, France's CAC 40 slipped 1.1%, while the UK's FTSE 100 index gained 0.1%.

Sentiment weak in Europe

Trump announced plans to impose an additional 10% tariff on all Chinese goods entering the U.S. and hinted at a 25% tariff on products from Mexico and Canada, effectively ending the existing regional free trade agreement.

While these policies don't mention Europe specifically, investors are worried that Trump will soon turn his eye onto this region, given he has previously threatened European tariffs, particularly on the auto sector.

That said, there are already European carmakers with major operations in Mexico, including Stellantis (NYSE:STLA ) and Volkswagen (ETR:VOWG_p ), and the threat of tariffs soon after he takes office in January gives these automakers little time to adapt to huge supply chain changes.

This comes with the automakers, as well as the rest of corporate Europe, having to cope with tepid demand in a region already struggling economically.

Data released earlier Wednesday showed that French consumer confidence fell to a five-month low in November as households fretted over the outlook for the economy and the job market.

Statistics agency INSEE said its consumer confidence index fell to 90 from a downwardly-revised 93 in October, well below the long-term average of 100 and its lowest point since June. EasyJet impresses with FY results

EasyJet (LON:EZJ ) stock rose 0.6% after the budget airline reported an increase in profit for fiscal year 2024, driven by a record summer and a 56% surge in holiday bookings.

Going forward, the airline targets 3% capacity growth and aims to reduce winter losses in FY25.

Just Eat Takeaway (AS:TKWY ) stock fell 0.5% in Amsterdam after the food delivery company revealed plans to delist from the London Stock Exchange (LON:LSEG ) by the end of the year, citing low trading volumes and high costs.

Johnson Matthey (LON:JMAT ) stock slumped 6% after the speciality chemicals company reported weaker-than-expected results for the first half of fiscal 2025. Crude oil helped by US inventories decline

Crude prices edged higher Wednesday, with traders assessing the potential impact of a ceasefire deal between Israel and Hezbollah as well as an unexpected, substantial draw in US oil inventories.

By 07:00 ET, the US crude futures (WTI) climbed 0.4% to $69.04 a barrel, while the Brent contract rose 0.3% to $72.55 a barrel.

Both benchmarks settled lower on Tuesday after Israel agreed to a ceasefire with Lebanon's Hezbollah.

The deal will take effect today, potentially ending a conflict across the Israeli-Lebanese border, quelling some concerns that persistent fighting in the Middle East will disrupt oil supplies from the crude-rich region.

Data from the American Petroleum Institute , released on Tuesday, indicated that US oil inventories shrank by nearly 6 million barrels in the week to Nov. 22, compared with the small build expected.

If confirmed by official data later Wednesday, this would increase hopes that US fuel demand remained strong, potentially tightening oil supplies in the coming months.

(Navamya Acharya contributed to this article.)

Source: Investing.com