Bessent in focus for US Treasury secretary after Paulson exits race

By Lawrence Delevingne

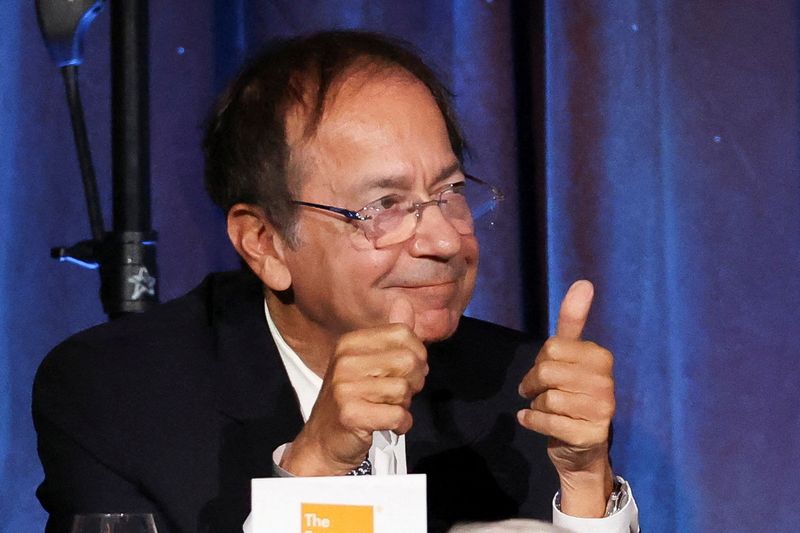

(Reuters) -Billionaire investor John Paulson said on Tuesday he was dropping out of contention for U.S. Treasury secretary in Donald Trump's new cabinet, putting the focus squarely on fellow investor Scott Bessent, the other main candidate in the race.

Paulson, who had been one of the frontrunners for the role under President-elect Trump, said on Tuesday his "complex financial obligations" will prevent him from holding an office in the new administration.

"I intend to remain actively involved with the president's economic team and helping in the implementation of President Trump's outstanding policy proposals," Paulson said in a statement. The Wall Street Journal earlier reported the statement.

Wall Street has been closely watching Trump's plans for the Treasury secretary role, especially as he has said he plans to reshape global trade through tariffs.

Paulson and Bessent had emerged as top contenders for the job, which has vast influence over economic, regulatory and international affairs, sources said on Friday. Both were financial backers of Trump's campaign.

Bessent has advocated for tax reform and deregulation, particularly to spur more bank lending and energy production, as noted in a recent opinion piece he wrote for The Wall Street Journal. The market's surge after Trump's election victory, he wrote, signaled investor "expectations of higher growth, lower volatility and inflation, and a revitalized economy for all Americans."

Representatives for Bessent did not respond to a request for comment.

Karoline Leavitt, a Trump-Vance Transition spokeswoman, said in an emailed statement that “President-elect Trump is making decisions on who will serve in his second administration. Those decisions will be announced when they are made."

Trump, who is set to return to the White House in January, has begun choosing a cabinet and selecting high-ranking administration officials.

Professional wrestling magnate and former Small Business Administration director Linda McMahon is viewed as the frontrunner to lead the Department of Commerce, while Susie Wiles, one of Trump's two campaign managers, has been picked to be his White House chief of staff.

FROM SOUTH CAROLINA TO SOROS

Bessent, 62, primarily lives in Charleston, South Carolina with his husband and two children.

He grew up in the fishing village of Little River, South Carolina, where Bessent has said his father, a real estate investor, experienced booms and busts.

“I’ve known financial anxiety and I do not want that for any family,” Bessent recently told Trump ally Roger Stone in an interview.

Bessent attended Yale College and considered journalism but, after graduating in 1984 with a degree in political science, took an internship on Wall Street. He later worked for noted short seller Jim Chanos in the late 1980s and then joined Soros Fund Management, the famed macroeconomic investment firm of billionaire George Soros. He soon helped Soros and top deputy Stanley Druckenmiller on their most famous trade - shorting the British pound in 1992 and earning the firm more than $1 billion.

In 2015, Bessent raised $4.5 billion, including $2 billion from Soros, to launch Key Square Group, a hedge fund firm that bets on macroeconomic trends. Key Square's main fund gained about 31% in 2022, according to media reports, but firm assets declined to approximately $577 million as of December 2023, according to a regulatory filing.

Bessent has said he has known the Trump family for 30 years through a friendship with Donald Trump’s late brother, Robert Trump. Bessent contributed to Donald Trump’s inauguration following his 2016 election win, but during the 2024 election cycle was more involved, serving as a top economic advisor to the campaign in addition to being a top fundraiser.

“I was all in for President Trump. I was one of the few Wall Street people backing him,” Bessent told Stone over the weekend.

Source: Investing.com