Stocks wobble ahead of US jobs data; bonds in the spotlight

By Stella Qiu and Amanda Cooper

SYDNEY/LONDON (Reuters) - Global stocks were under pressure on Friday ahead of a U.S. jobs report later on that could exacerbate or ease the sell-off in the global bond market, while the pound headed for a fourth daily drop, after British debt yields soared to 16-year highs.

Volatility was more subdued in early European trading as traders stuck to their positions ahead of the upcoming employment data after this week's gyrations across markets.

European stocks got off to a limp start, with the STOXX 600 mildly in negative territory, as gains in telecoms and basic materials offset losses in more defensive sectors, such as utilities and consumer staples.

Nasdaq futures and S&P 500 futures were down 0.3% to 0.4%, indicating a softer start on Wall Street later, where markets closed overnight to mark the funeral of former U.S. President Jimmy Carter.

The closely watched U.S. nonfarm payrolls report at 8:30 a.m. U.S. Eastern time (1330 GMT) is forecast to show a rise of 160,000 in jobs in December, while unemployment holds at 4.2%.

Anything stronger could see 10-year Treasury yields spike to 13-month peaks and lift the U.S. dollar in the process.

Analysts at ING believe a result below 150,000 new jobs would be needed to stop Treasury yields from rising further.

"Payrolls, as always, are a pivotal report. But we need to deviate materially from consensus to have an effect this time around," said Padhraic Garvey, regional head of research, Americas, at ING.

"Given the move already in Treasuries, there is some talk that Friday's numbers will need to be strong to continue this momentum, and in that sense there is some vulnerability for a lower yield reaction to a consensus outcome."

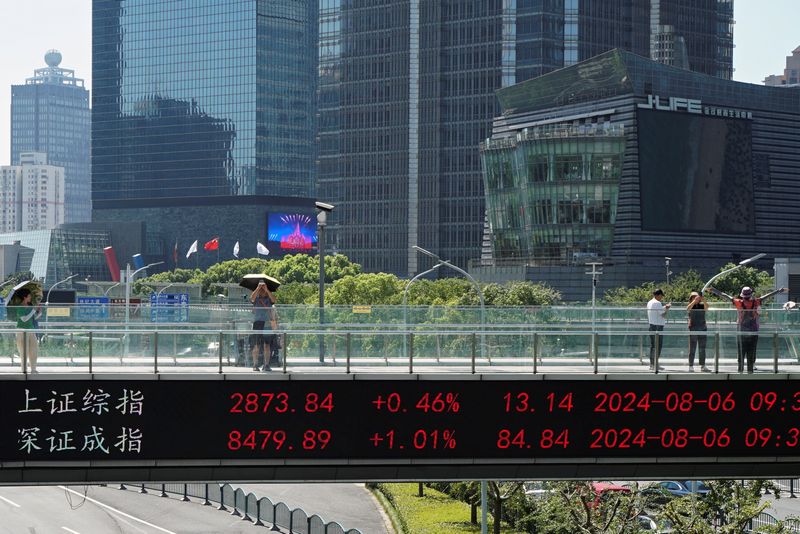

In Asia, Japan's Nikkei fell 0.9%, taking its weekly loss to 1.6%, while the MSCI index of Asia-Pacific shares outside Japan closed 1.2% lower on the week.

The VIX volatility index, a measure of investor nervousness, was flat on the day in European trading, having touched a three-week high earlier this week, when anxiety about the rise in global long-term bond yields peaked.

FED CAUTION

Fed officials Patrick Harker, the president of the Philadelphia Fed, and Kansas City President Jeff Schmid signaled they did not believe the central bank needed to cut rates imminently.

This had little bearing on market pricing, as traders have already only priced in around 43 basis points of U.S. rate cuts for 2025. Concerns about President-elect Donald Trump's potentially inflationary agenda have helped set these expectations and have been at the heart of this week's rise in long-term bond yields.

The benchmark 10-year U.S. Treasury yield rose 2 basis points to 4.6998%, below Wednesday's eight-month peak of 4.73%. Traders are watching the 4.739% mark, as a break above here could trigger a rise to 5%, a level not seen since 2007.

This week's 9.6 basis point rise in Treasury yields has helped push the dollar to a sixth weekly rise. In sharp contrast, UK gilt yields have risen nearly a quarter of a percentage point to around 4.8%, their highest since 2008, which has weighed on the pound.

The pound fell for a fourth day on Friday, dropping 0.1% to $1.22915, having hit its lowest since November 2023 overnight, as concern has mounted over Britain's finances in light of the sharp increase in government borrowing costs, which outweighed the appeal of higher returns on UK assets.

A strong U.S. payrolls report could dent sterling further, according to XTB research director Kathleen Brooks.

"A strong payrolls report could add to the selling pressure on UK bonds and increase fears of a fiscal crisis in the UK. It could also weigh on the pound, which has been one of the weakest performers in the FX market since the start of this year," she said.

In commodities, oil prices rose on Friday, with Brent crude futures up 1.2% to $77.81 a barrel, while European natural gas prices, fell 2.9%, set for a near-9% fall this week.

Gold prices headed for a 1.4% weekly rise, trading around $2,677, close to its highest since December.

Source: Investing.com