Bond selloff eases in Asia, stocks fall with eyes on UK gilts, US policy

By Kevin Buckland and Chibuike Oguh

TOKYO (Reuters) -A global bond rout eased on Thursday and the dollar held steady near its highest levels in more than a year, although stocks continued to fall with most Asian indexes down on the day.

The benchmark 10-year U.S. Treasury yield eased to 4.6648% in Asia from an overnight peak of 4.73%, which was the highest level since April 2024.

Equivalent-maturity Japanese government bond yields started the day by rising 1 basis point to the highest since May 2011 at 1.185%, but later followed the wider trend and were flat as of 0537 GMT.

Similar-dated Australian sovereign yields matched Wednesday's peak of 4.546%, which is also the highest level since late November, but were last at 4.491%.

All eyes are now turning to UK bonds, which have been at the centre of the selloff, with growing concern about Britain's economic and fiscal health, despite no obvious trigger for this week's 20-bps surge in 10-year gilt yields.

"Clearly there is reason to watch the UK bond market intently, and the recent trend is certainly concerning," Chris Weston, head of research at Pepperstone, said. "However, we can take some assurances that the BoE (Bank of England) is more prepared this time around."

Sterling sagged 0.26% to $1.23325, extending its 0.9% slump from Wednesday.

The U.S. dollar index , which gauges the currency against sterling, the euro and four other major peers, edged up to 109.07, sitting not too far from the highest level since November 2022 of 109.54, reached a week ago.

PRESSURE POINTS

The latest boost for the dollar and U.S. Treasury yields follows recent signs of resilience in the U.S. economy and inflation, which had prompted markets to reduce expectations for Federal Reserve rate cuts this year.

Minutes of the Fed's December policy meeting, released on Wednesday, showed officials were concerned that President-elect Donald Trump's proposed tariffs and immigration policies may prolong the fight against inflation.

Selling in Treasuries on Wednesday accelerated after a CNN report Trump was considering declaring a national economic emergency to provide a legal justification for a series of universal levies on allies and adversaries.

Markets are fully pricing in just one 25-bp rate cut in 2025, and see around a 60% chance of a second.

All that has combined to make global stock market sentiment fragile, and Asian equities were mostly in the red on Thursday.

Japan's Nikkei dropped 1.2%, with the additional headwind of a rebounding yen, which added about 0.2% to 158.08 per dollar following its slide to a nearly six-month trough of 158.55 per dollar on Wednesday.

Australia's stock benchmark slipped 0.5%, while Taiwanese shares lost 1.1%.

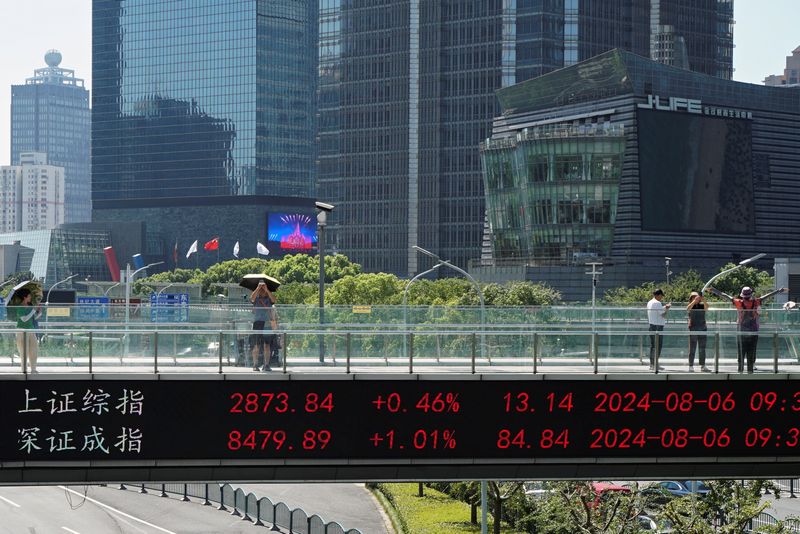

Hong Kong's Hang Sang and mainland Chinese blue chips were both little changed.

U.S. S&P 500 futures pointed 0.2% lower, after the cash index eked out a 0.2% gain overnight.

Pan-European STOXX 50 futures were slightly lower, though UK FTSE futures added 0.2%.

U.S. stock markets are closed on Thursday and Treasuries have a shortened session to mark a national day of mourning following the death of former President Jimmy Carter.

On Friday, the closely watched U.S. monthly payrolls report will provide clues on the Fed policy outlook.

China's yuan steadied near a 16-month low against the dollar as the nation's central bank announced a record amount of offshore yuan bill sales to support the currency.

"This move underscores Chinese policymakers' unwavering preference for currency stability," said Shoki Omori, a strategist at Mizuho (NYSE:MFG ) Securities, predicting the Chinese currency will firm to 7.22 per dollar by year-end.

The onshore yuan traded little changed at 7.3310 per dollar, but was not far from the previous day's low of 7.3322, the weakest since September 2023.

Oil prices edged lower, pressured by recent dollar strength and large builds in U.S. fuel inventories last week.

Brent crude futures eased 4 cents to $76.11 a barrel. U.S. West Texas Intermediate crude fell 8 cents to $73.24.

Gold prices edged down 0.1% to around $2,659 an ounce from an overnight peak of $2,670.10, its highest level since Dec. 13.

Leading cryptocurrency bitcoin was steady around $94,508, following a two-day slide of 7%. ($1 = 7.3314 Chinese yuan)

Source: Investing.com