Oil prices slide 1% to 7-week low as China concerns weigh

By Scott DiSavino

NEW YORK (Reuters) - Oil prices slid about 1% to a seven-week low on Tuesday on worries about weaker demand from China and a stronger U.S. dollar, and concerns OPEC+ could boost supplies in the future.

Brent futures for September delivery fell $1.01, or 1.3%, to $78.77 a barrel by 12:21 p.m. EDT (1621 GMT), while U.S. West Texas Intermediate (WTI) crude fell 86 cents, or 1.1%, to $74.95.

That puts both benchmarks on track for their lowest closes since June 5 and kept both in technically oversold territory for a second day in a row.

In addition to crude, U.S. futures for diesel and gasoline were also trading at their lowest levels since early June.

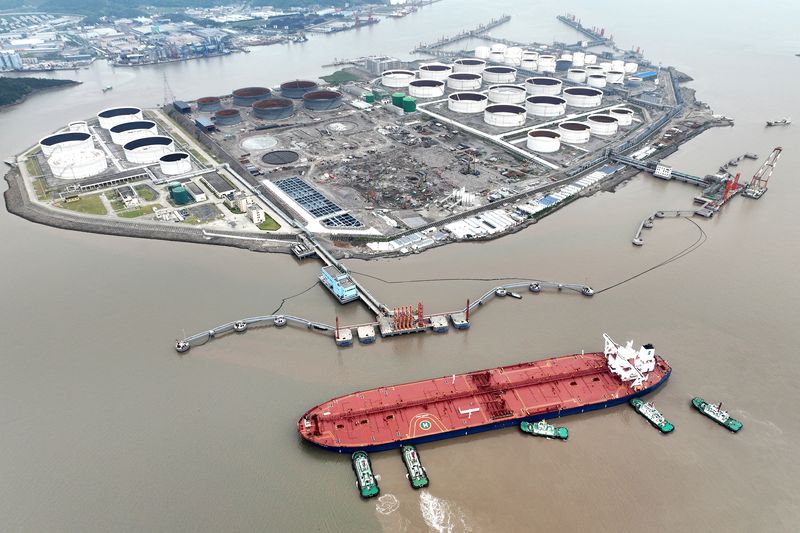

A string of disappointing economic news from China, the world's largest crude importer, has been weighing on commodity prices. China's manufacturing activity likely shrunk for a third month in July, according to a Reuters poll.

"Weakening global demand growth, an unresolved economic outlook in China and still-elevated global oil inventories are continuing to weigh on prices" said Claudio Galimberti of consultancy Rystad Energy.

Even as Chinese leaders vowed to step up support for the economy, expectations on the extent of such measures have been limited since the Third Plenum policy meeting largely reiterated existing economic policy goals.

The U.S. dollar rose to a two-week high versus a basket of other currencies before the U.S. Federal Reserve’s July 30-31 policy meeting, where any new clues of a September rate cut will be in focus.

The Fed is expected hold its benchmark overnight interest rate steady at the July meeting and signal that rate cuts may begin as soon as the U.S. central bank's September meeting.

The Fed hiked rates aggressively in 2022 and 2023 to tame a surge in inflation. Higher interest rates increase borrowing costs for consumers and businesses, which can reduce economic growth and demand for oil.

A stronger U.S. dollar, meanwhile, can reduce demand for oil by making greenback-denominated commodities like crude more expensive for holders of other currencies.

Coming up on Thursday, top ministers from OPEC+, the Organization of the Petroleum Exporting Countries (OPEC) along with allies like Russia, will meet to review the market, including a plan to start unwinding some output cuts from October. No changes are currently expected.

In OPEC-member Venezuela, the political opposition said it had won 73% of the vote in Sunday's presidential election despite the national electoral authority having declared incumbent Nicolas Maduro as the winner.

The Organization of American States' election observation department said it cannot recognize the results by Venezuela's national electoral council.

"Nicolas Maduro's victory in the latest Venezuelan election is a headwind for global supply, as this could result in tighter U.S. sanctions," ANZ analysts said in a note, estimating such a scenario could cut Venezuela's exports by 100,000-120,000 barrels per day.

U.S. OIL INVENTORIES

The market could gain some support from weekly U.S. oil storage data from the American Petroleum Institute (API) trade group later on Tuesday and the U.S. Energy Information Administration (EIA) on Wednesday.

Analysts projected U.S. energy firms pulled about 2.3 million barrels of crude out of storage during the week ended July 26. [EIA/S] [API/S]

If correct, that would be the first time U.S. crude stocks declined for five weeks in a row since January 2022 and compares with a record weekly decrease of 17.0 million barrels in the same week last year and an average decline over the past five years (2019-2023) of 7.2 million barrels for that week.

Source: Investing.com