Oil prices inch up on Fed rate cut outlook

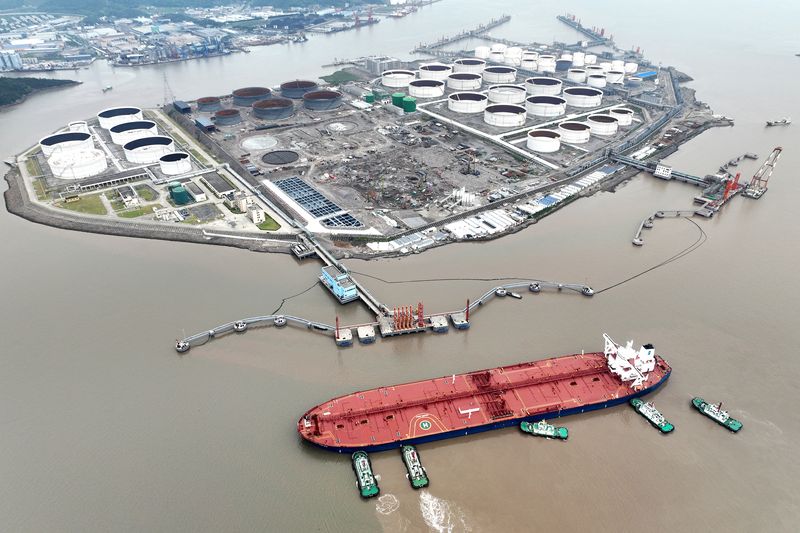

SINGAPORE (Reuters) - Oil prices edged up in early trade on Monday amid expectations of a U.S. interest rate cut this week, though gains were capped by U.S. supply resumptions following Hurricane Francine and weaker China data.

Brent crude futures for November were up 15 cents, or 0.2% at $71.76 a barrel at 0015 GMT. U.S. crude futures for October were up 23 cents, or 0.3%, at $68.88 a barrel.

Both contracts had settled lower in the previous session, with concerns about supply disruptions easing as Gulf of Mexico crude production resumed following Hurricane Francine and as rising data showed a weekly rise in U.S. rig count.

Still, nearly a fifth of crude oil production and 28% of natural gas output in the Gulf of Mexico remain offline in the hurricane's aftermath.

A key factor that will dominate the market this week is how aggressive a rate cut the U.S. Federal Reserve will deliver following its Sept. 17-18 meeting. Fed fund futures show investors are increasingly betting the central bank will cut by 50 basis points instead of 25 bps, according to CME FedWatch.

Lower interest rates will reduce the cost of borrowing, which can boost economic activity and lift demand for oil.

"We remain in the gradualist camp and expect the Fed to begin cutting by 25 basis points," ANZ analysts in a note.

In China, the world's top oil importer, industrial output growth slowed to a five-month low in August, while retail sales and new home prices weakened further. Oil refinery output also fell for a fifth month, as disappointing fuel demand and weak export margins curbed production.

Meanwhile, the dollar remained steady after Republican presidential candidate Donald Trump was safe following what the FBI said appeared to be a second assassination attempt outside his golf course in Florida.

In the Middle East, Prime Minister Benjamin Netanyahu said Israel would inflict a "heavy price" on the Iran-aligned Houthis, after they reached central Israel with a missile on Sunday for the first time.

Source: Investing.com