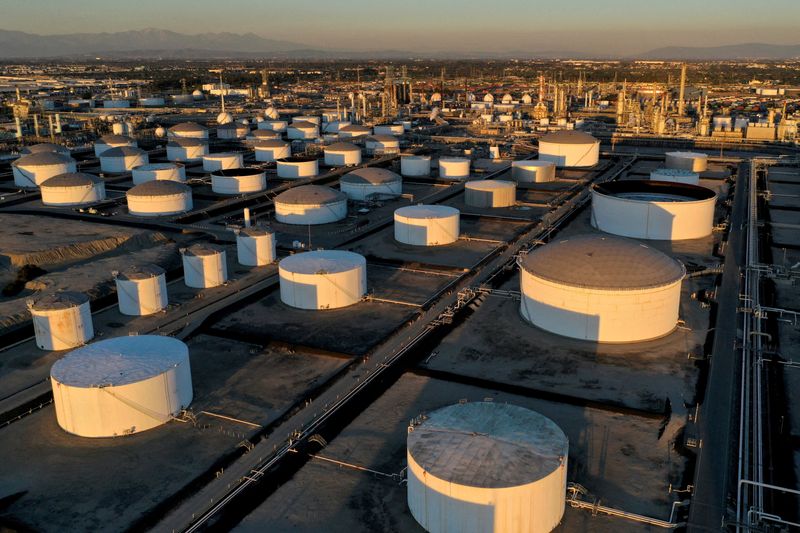

Oil edges higher US interest rate cut counters weak demand

By Arunima Kumar

(Reuters) -Oil prices rose slightly on Monday after last week's cut to U.S. interest rates and a dip in U.S. crude supply in the aftermath of Hurricane Francine countered weaker demand from top oil importer China.

Brent crude futures for November edged up by 14 cents, or 0.19%, to $74.63 a barrel by 0815 GMT. U.S. crude futures for November were up 16 cents, or 0.23%, at $71.16.

Both contracts registered their second consecutive weekly gains last week after the U.S. Federal Reserve cut interest rates by half a percentage point, a larger decrease in borrowing costs than many expected.

"Oil looks rangebound despite the uplift to risky asset prices from an outsized policy rate cut by the Fed last week," said Harry Tchilinguirian, head of research at Onyx Capital Group

"The market will look to flash purchasing managers' index (PMI) releases in Europe and the U.S. for economic direction, and if these disappoint, then there is likely to be downward pressure developing on oil prices."

Euro zone business activity contracted sharply and unexpectedly this month as the bloc's dominant services industry flatlined while a downturn in manufacturing accelerated, a survey showed on Monday.

A softer economic outlook from top consumer China capped further gains.

"There was some hope earlier this morning that some additional Chinese monetary stimulus is likely in the short term, but the latest PMI out of Europe switched market sentiment from positive to negative," said UBS analyst Giovanni Staunovo.

"I would expect oil to benefit this week from a large U.S. crude draw as result of elevated U.S. crude exports."

However, heightened conflict in the Middle East could curtail regional supply.

The Israeli military launched its most widespread wave of air strikes against Iran-backed Hezbollah, targeting Lebanon's south, eastern Bekaa valley and northern region near Syria simultaneously after nearly a year of conflict.

"Geopolitical tensions in the Middle East have edged up a notch between Israel and Hezbollah, which could leave oil prices well supported on the risks of a wider regional conflict," said IG market strategist Yeap Jun Rong.

Source: Investing.com