Oil drops to two-month low as China concerns weigh

By Alex Lawler and Robert Harvey

LONDON (Reuters) -Oil traded at its lowest levels since early June on Tuesday as worries about demand in China offset the prospect of lower U.S. crude and product inventories.

Brent crude fell by 77 cents, or 0.97%, to $79.01 a barrel by 1317 GMT. U.S. WTI crude was down 66 cents, or 0.87%, at $75.15.

At their intra-day lows, both contracts were down by more than $1. The front-month Brent contract traded at a low of $78.67 and WTI at $74.75, the weakest for both benchmarks since June 6.

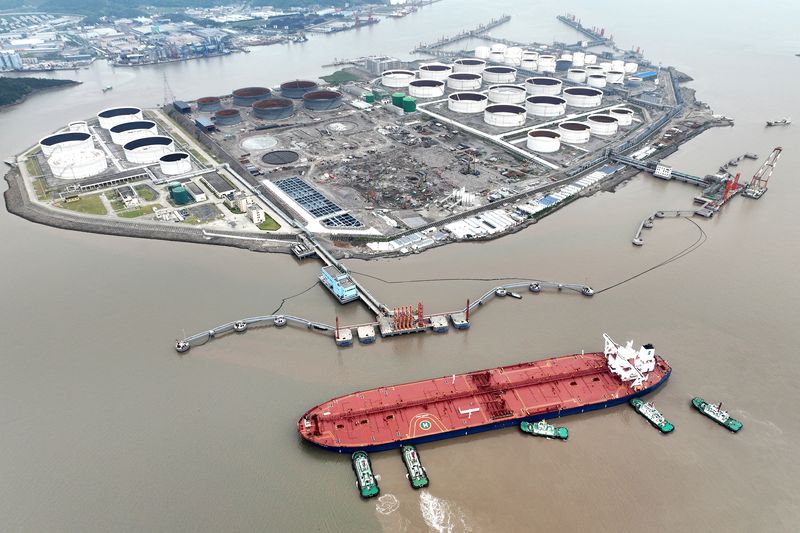

A string of disappointing economic news from China, the world's largest crude importer, has been weighing on commodity prices. China's manufacturing activity is likely to have shrunk for a third month in July, a Reuters poll showed on Monday.

"Weakening global demand growth, an unresolved economic outlook in China and still-elevated global oil inventories are continuing to weigh on prices" said Claudio Galimberti of constulancy Rystad Energy.

Even as Chinese leaders vowed to step up support for the economy, expectations on the extent of such measures have been limited since the Third Plenum policy meeting largely reiterated existing economic policy goals.

Coming up on Thursday, top ministers from OPEC+, the Organization of the Petroleum Exporting Countries along with allies led by Russia, will meet to review the market, including a plan to start unwinding some output cuts from October. No changes are currently expected.

Oil fell 2% in the previous session after Israel signalled that its response to a rocket strike in Israeli-occupied Golan Heights on Saturday would be calculated to avoid dragging the Middle East into an all-out war.

In OPEC-member Venezuela, the opposition said it had won 73% of the vote in Sunday's presidential election despite the national electoral authority having declared incumbent Nicolas Maduro as the winner.

"Nicolas Maduro's victory in the latest Venezuelan election is a headwind for global supply, as this could result in tighter U.S. sanctions," ANZ analysts said in a note, estimating that such a scenario could cut Venezuela's exports by 100,000-120,000 barrels per day.

Some support could come from U.S. inventory reports due this week, which are expected to show lower crude and fuel stocks.

Source: Investing.com